Search within this section

Select a section below and enter your search term, or to search all click IFRS In depths

Favorited Content

Key points

Definitions of terms used in this publication |

|---|

GloBE effective tax rate = GloBE tax expense/income ÷ GloBE profit/loss

Statutory tax rate = Enacted tax rate

IAS 12 effective tax rate = IAS 12 tax expense/income ÷ IFRS profit/loss

|

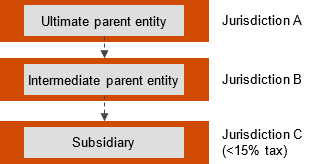

Illustrative example where the jurisdiction of the ultimate parent entity has not enacted the Pillar Two rules |

|---|

Assume that the group has recorded consolidated revenue (as defined by the OECD) of €750m in at least two of the last four years, which would result in the group being within the scope of the Pillar Two rules. The GloBE effective tax rates in jurisdictions A, B and C are 25%, 22% and 5% respectively.

The status of Pillar Two rules implementation for each of the jurisdictions is as follows:

Question In this scenario, is the consolidated group in jurisdiction A considered to be impacted by the Pillar Two rules for purposes of the disclosure requirements under IAS 12?

Answer

Yes. The Pillar Two rules do not apply to the ultimate parent entity, and so no GloBE top-up tax is collected in jurisdiction A. Instead, the jurisdiction of the next intermediate parent entity (jurisdiction B in this example) applies the IIR and imposes top-up tax on the intermediate parent entity for the low-tax jurisdiction C.

Since the group has been impacted by the Pillar Two rules, the disclosure requirements of IAS 12 would be applicable to the consolidated financial statements prepared by the ultimate parent entity.

|

Disclosure example – legislation substantively enacted but not in effect |

|

|---|---|

A parent entity might be in a jurisdiction where the Pillar Two legislation is substantively enacted, but not yet in effect at the group’s reporting date. For example, as of 31 December 2023 the jurisdiction of the parent entity might have substantively enacted the Pillar Two legislation that will become effective from 1 January 2025.

To meet the disclosure requirements of IAS 12 above, an entity that is within the scope of the Pillar Two rules should disclose qualitative and quantitative information about its exposure to Pillar Two income taxes in its annual financial statements as of 31 December 2023. That information need not necessarily reflect all of the specific requirements of the legislation and could be provided in the form of an indicative range.

Disclosures that might be considered are as follows:

To the extent that information is not known or reasonably estimable, the entity should instead disclose a statement to that effect and information about its progress in assessing its exposure. Management will need to be able to support any statement that Pillar Two will not have a material impact. An illustrative example of what an entity might consider disclosing in its financial statements for the year ended 31 December 2023 is as follows.

OECD Pillar Two model rules

The group is within the scope of the OECD Pillar Two model rules. Pillar Two legislation was enacted in country X, the jurisdiction in which the company is incorporated, and will come into effect from 1 January 2025. Since the Pillar Two legislation was not effective at the reporting date, the group has no related current tax exposure. The group applies the exception to recognising and disclosing information about deferred tax assets and liabilities related to Pillar Two income taxes, as provided in the amendments to IAS 12 issued in May 2023.

Under the legislation, the group is liable to pay a top-up tax for the difference between its GloBE effective tax rate per jurisdiction and the 15% minimum rate. All entities within the group have an effective tax rate that exceeds 15%, except for one subsidiary that operates in jurisdiction A.

For 2023, the average effective tax rate (calculated in accordance with para 86 of IAS 12) of the entity operating in jurisdiction A is:

|

|

Group entity operating in

jurisdiction A CU’000 |

|

Tax expense for year ending 31 December 2023

|

250

|

Accounting profit for year ending 31 December 2023

|

3,000

|

Average effective tax rate

|

8.3%

|

The group is in the process of assessing its exposure to the Pillar Two legislation for when it comes into effect. This assessment indicates for jurisdiction A that the average effective tax rate based on accounting profit is 8.3% for the annual reporting period to 31 December 2023. However, although the average effective tax rate is below 15%, the group might not be exposed to paying Pillar Two income taxes in relation to jurisdiction A. This is due to the impact of specific adjustments envisaged in the Pillar Two legislation which give rise to different effective tax rates compared to those calculated in accordance with paragraph 86 of IAS 12.

Due to the complexities in applying the legislation and calculating GloBE income, the quantitative impact of the enacted or substantively enacted legislation is not yet reasonably estimable. Therefore, even for those entities with an accounting effective tax rate above 15%, there might still be Pillar Two tax implications. The group is currently engaged with tax specialists to assist it with applying the legislation.

|

|

Disclosure example – legislation not substantively enacted |

|---|

In December 2021, the Organisation for Economic Co-operation and Development (OECD) issued model rules for a new global minimum tax framework (Pillar Two), and various governments around the world have issued, or are in the process of issuing, legislation on this. In [Country X], the government released draft legislation on Pillar Two in [July 2023]. The group is in the process of assessing the full impact of this.

|

Timeline for impact of Pillar Two on accounting |

|---|

The disclosure requirements will depend on the extent to which Pillar Two legislation has been enacted in the jurisdictions in which the group operates and whether it is in effect. The timeline below sets out the required disclosures at the various stages of the process.

It also illustrates when the impact of top-up taxes should be considered in the going concern assessment and in impairment tests.

|

Estimated annual accounting profit |

C1000.0 |

|---|---|

Estimated total income tax charge (current and deferred) excluding P2

|

C 130.0

|

Estimated P2 top up tax (see below for illustrated calculation)

|

C91.0

|

Total estimated annual tax charge

|

C221.0

|

ETR for interim purposes (C221/C1000) ) (income tax component 13% P2 component 9.1%)

|

22.1%

|

Interim accounting profit

|

C500.0

|

Interim tax charge (22.1% x C500)

|

C110.5

|

Balance sheet liability

|

C110.5

|

Comprises

|

|

Corporation tax (500 x 13%) - to be split between current and deferred as appropriate

|

C65.0

|

P2 tax (500 x 9.1%)

|

C45.5

|

Estimated annual accounting profit |

C1000 |

|---|---|

Estimated P2 adjustments

|

C300

|

Estimated P2 income (a)

|

C1300

|

Estimated total accounting tax charge (current and deferred)

|

C130

|

Estimated P2 covered taxes adjustments

|

-C26

|

Estimated covered taxes (b)

|

C104

|

P2 ETR (b/a)

|

8%

|

Minimum rate

|

15%

|

Estimated P2 top up tax rate (15%-8% = 7%)

|

7%

|

Estimated P2 income (a above)

|

C1300

|

Less substance based income exclusion (assumed zero for illustration)

|

C0

|

Estimated P2 top up tax income

|

C1300

|

Estimated P2 top up tax 7% x C1300

|

C91

|

H1 |

H2 |

|

|---|---|---|

Accounting result

|

-C5000

|

C6000

|

Tax (credit)/charge (22.1%)

|

-C1105

|

C1326

|

Comprises

|

||

Corporation tax (credit)/charge (13%)

|

-C650

|

C780

|

P2 tax (credit)/charge (9.1%)

|

-C455

|

C546

|

Balance sheet asset/(liability)

|

C1105

|

-C221

|

Comprises:

|

||

Corporation tax asset/(liability) excluding P2 (to be split between current and deferred as appropriate)

|

C650

|

-C130

|

P2 tax asset/(liability)

|

C455

|

-C91

|

H1 |

H2 |

|

|---|---|---|

Accounting result

|

-C5000

|

C6000

|

Tax (credit)/charge

|

-C650

|

C871

|

Comprises

|

||

Corporation tax (credit)/charge (13%)

|

-C650

|

C780

|

P2 tax (credit)/charge

|

C0

|

C91

|

Balance sheet asset/(liability)

|

C650

|

-C221

|

Comprises:

|

||

Corporation tax asset/liability excluding P2 (to be split between current and deferred as appropriate)

|

C650

|

-C130

|

P2 tax liability

|

C0

|

-C91

|

© #year# PricewaterhouseCoopers LLP. This content is copyright protected. It is for your own use only - do not redistribute. These materials were downloaded from PwC's Viewpoint (viewpoint.pwc.com) under licence.

Any trademarks included are trademarks of their respective owners and are not affiliated with, nor endorsed by, PwC. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

Select a section below and enter your search term, or to search all click IFRS In depths