3. Amend paragraphs 350-20-15-3A through 15-4, with no link to a transition paragraph, as follows:

Intangibles—Goodwill and Other—Goodwill

Overview and Background

General

350-20-05-1 This Subtopic addresses financial accounting and reporting for goodwill subsequent to its acquisition and for the cost of internally developing goodwill.

350-20-05-2 Subtopic 805-30 provides guidance on recognition and initial measurement of goodwill acquired in a business combination. Subtopic 958-805 provides guidance on recognition and initial measurement of goodwill acquired in an acquisition by a not-for-profit entity.

350-20-05-3 Paragraph superseded by Accounting Standards Update No. 2017-04.

350-20-05-4 The guidance in this Subtopic is presented in the following two Subsections:

- General

- Accounting Alternative.

350-20-05-4A Costs of developing, maintaining, or restoring internally generated goodwill should not be capitalized. For entities that do not elect the accounting alternative included in the guidance in the Subsections outlined in paragraph 350-20-05-5A, goodwill that is recognized under the business combination guidance in

Topic 805 and

Subtopic 958-805 should not be amortized. Instead, it should be tested for impairment at least annually in accordance with paragraphs 350-20-35-28 through 35-32.

350-20-05-4B This Subtopic also includes guidance on the following:

- How an entity should derecognize goodwill when it disposes of all or a portion of a reporting unit

- How goodwill should be presented in the balance sheet

- How impairment losses should be presented in the income statement

- What disclosures about goodwill and related impairment considerations should be made in the notes to the financial statements.

Accounting Alternative

350-20-05-5 The Accounting Alternative Subsections of this Subtopic provide guidance for an entity within the scope of paragraph 350-20-15-4 that elects the accounting alternative for goodwill. If elected, the accounting alternative allows an eligible entity to amortize goodwill and test that goodwill for impairment upon a triggering event.

350-20-05-5A The accounting alternative guidance can be found in the following paragraphs:

- Scope and Scope Exceptions—paragraphs 350-20-15-4 through 15-5

- Subsequent Measurement—paragraphs 350-20-35-62 through 35-82

- Derecognition—paragraphs 350-20-40-8 through 40-9

- Other Presentation Matters—paragraphs 350-20-45-4 through 45-7

- Disclosure—paragraphs 350-20-50-4 through 50-7

- Implementation Guidance and Illustrations—paragraph 350-20-55-26.

350-20-05-6 An entity should continue to follow the applicable requirements in

Topic 350 for other accounting and reporting matters related to goodwill that are not addressed in the Accounting Alternative Subsections of this Subtopic.

Scope and Scope Exceptions

General

> Transactions

350-20-15-3A Paragraphs 350-20-15-4 through 15-5, 350-20-35-62 through 35-82, 350-20-40-8 through 40-9, 350-20-45-4 through 45-7, 350-20-50-4 through 50-7, 350-20-55-26, and 323-10-35-13 provide guidance for an entity electing the accounting alternative in this Subtopic. See paragraph 350-20-65-2 for transition guidance

for private companies and not-for-profit entities on applying the accounting alternative in

Subtopic 350-20.

Accounting Alternative

350-20-15-4 A private company or not-for-profit entity may make an accounting policy election to apply the accounting alternative in this Subtopic. The guidance in the Accounting Alternative Subsections of this Subtopic applies to the following transactions or activities:

- Goodwill that an entity recognizes in a business combination in accordance with Subtopic 805-30 or in an acquisition by a not-for-profit entity in accordance with Subtopic 958-805 after it has been initially recognized and measured

- Amounts recognized as goodwill in applying the equity method of accounting in accordance with Topic 323 on investments—equity method and joint ventures, and to the excess reorganization value recognized by entities that adopt fresh-start reporting in accordance with Topic 852 on reorganizations.

350-20-15-5 An entity within the scope of the preceding paragraph that elects the accounting alternative shall apply all of the related subsequent measurement, derecognition, other presentation matters, and disclosure requirements upon election. The accounting alternative, once elected, shall be applied to existing goodwill and to all additions to goodwill recognized in future transactions within the scope of this accounting alternative.

4. Amend paragraph 350-20-35-63, with no link to a transition paragraph, as follows:

Subsequent Measurement

Accounting Alternative

350-20-35-62 The following guidance for goodwill applies to entities within the scope of paragraph 350-20-15-4 that elect the accounting alternative for the subsequent measurement of goodwill.

> Amortization of Goodwill

350-20-35-63 Goodwill relating to each business combination, acquisition by a not-for-profit entity, or reorganization event resulting in fresh-start reporting (amortizable unit of goodwill) shall be amortized on a straight-line basis over 10 years, or less than 10 years if the entity demonstrates that another useful life is more appropriate.

350-20-35-64 An entity may revise the remaining useful life of goodwill upon the occurrence of events and changes in circumstances that warrant a revision to the remaining period of amortization. However, the cumulative amortization period for any amortizable unit of goodwill cannot exceed 10 years. If the estimate of the remaining useful life of goodwill is revised, the remaining carrying amount of goodwill shall be amortized prospectively on a straight-line basis over that revised remaining useful life.

> Recognition and Measurement of a Goodwill Impairment Loss

350-20-35-65 Upon adoption of this accounting alternative, an entity shall make an accounting policy election to test goodwill for impairment at the entity level or the reporting unit level. An entity that elects to perform its impairment tests at the reporting unit level shall refer to paragraphs 350-20-35-33 through 35-38 and paragraphs 350-20-55-1 through 55-9 to determine the reporting units of an entity.

> > When to Test Goodwill for Impairment

350-20-35-66 Goodwill of an entity (or a reporting unit) shall be tested for impairment if an event occurs or circumstances change that indicate that the fair value of the entity (or the reporting unit) may be below its carrying amount (a triggering event). Paragraph 350-20-35-3C(a) through (g) includes examples of those events or circumstances. Those examples are not all-inclusive, and an entity shall consider other relevant events and circumstances that affect the fair value or carrying amount of the entity (or of a reporting unit) in determining whether to perform the goodwill impairment test. If an entity determines that there are no triggering events, then further testing is unnecessary.

> > The Goodwill Impairment Test

350-20-35-67 Upon the occurrence of a triggering event, an entity may assess qualitative factors to determine whether it is more likely than not (that is, a likelihood of more than 50 percent) that the fair value of the entity (or the reporting unit) is less than its carrying amount, including goodwill. Paragraph 350-20-35-3C(a) through (g) includes examples of those qualitative factors.

350-20-35-68 Because the examples included in paragraph 350-20-35-3C(a) through (g) are not all-inclusive, an entity shall consider other relevant events and circumstances that affect the fair value or carrying amount of the entity (or of the reporting unit) in determining whether to perform the quantitative goodwill impairment test. An entity shall consider the extent to which each of the adverse events and circumstances identified could affect the comparison of its fair value with its carrying amount (or of the reporting unit’s fair value with the reporting unit’s carrying amount). An entity should place more weight on the events and circumstances that most affect its fair value or the carrying amount of its net assets (or the reporting unit’s fair value or the carrying amount of the reporting unit’s net assets). An entity also should consider positive and mitigating events and circumstances that may affect its determination of whether it is more likely than not that its fair value is less than its carrying amount (or the fair value of the reporting unit is less than the carrying amount of the reporting unit). If an entity has a recent fair value calculation (or recent fair value calculation for the reporting unit), it also should include that calculation as a factor in its consideration of the difference between the fair value and the carrying amount in reaching its conclusion about whether to perform the quantitative goodwill impairment test.

350-20-35-69 An entity shall evaluate, on the basis of the weight of evidence, the significance of all identified events and circumstances in the context of determining whether it is more likely than not that the fair value of the entity (or the reporting unit) is less than its carrying amount. None of the individual examples of events and circumstances included in paragraph 350-20-35-3C(a) through (g) are intended to represent standalone events or circumstances that necessarily require an entity to perform the quantitative goodwill impairment test. Also, the existence of positive and mitigating events and circumstances is not intended to represent a rebuttable presumption that an entity should not perform the quantitative goodwill impairment test.

350-20-35-70 An entity has an unconditional option to bypass the qualitative assessment described in paragraphs 350-20-35-67 through 35-69 and proceed directly to a quantitative calculation by comparing the entity’s (or the reporting unit’s) fair value with its carrying amount (see paragraphs 350-20-35-72 through 35-78). An entity may resume performing the qualitative assessment upon the occurrence of any subsequent triggering events.

350-20-35-71 If, after assessing the totality of events or circumstances such as those described in paragraph 350-20-35-3C(a) through (g), an entity determines that it is not more likely than not that the fair value of the entity (or the reporting unit) is less than its carrying amount, further testing is unnecessary.

350-20-35-72 If, after assessing the totality of events or circumstances such as those described in paragraph 350-20-35-3C(a) through (g), an entity determines that it is more likely than not that the fair value of the entity (or the reporting unit) is less than its carrying amount or if the entity elected to bypass the qualitative assessment in paragraphs 350-20-35-67 through 35-69, the entity shall determine the fair value of the entity (or the reporting unit) and compare the fair value of the entity (or the reporting unit) with its carrying amount, including goodwill. A goodwill impairment loss shall be recognized if the carrying amount of the entity (or the reporting unit) exceeds its fair value.

350-20-35-73 A goodwill impairment loss, if any, shall be measured as the amount by which the carrying amount of an entity (or a reporting unit) including goodwill exceeds its fair value. A goodwill impairment loss shall not exceed the entity’s (or the reporting unit’s) carrying amount of goodwill.

Pending Content:

Transition Date: (P) December 16, 2019; (N) December 16, 2021 I Transition Guidance: 350-20-65-3

350-20-35-73 A goodwill impairment loss, if any, shall be measured as the amount by which the carrying amount of an entity (or a reporting unit) including goodwill exceeds its fair value, limited to the total amount of goodwill of the entity (or allocated to the reporting unit). Additionally, an entity shall consider the income tax effect from any tax deductible goodwill on the carrying amount of the entity (or the reporting unit), if applicable, in accordance with paragraph 350-20-35-8B when measuring the goodwill impairment loss. See Example 2A in paragraph 350-20-55-23A for an illustration.

350-20-35-74 The guidance in paragraphs 350-20-35-22 through 35-27 shall be considered in determining the fair value of the entity (or the reporting unit).

350-20-35-75 The guidance in paragraphs 350-20-35-39 through 35-44 shall be considered in assigning acquired assets (including goodwill) and assumed liabilities to the reporting unit when determining the carrying amount of a reporting unit.

350-20-35-76 For an entity subject to the requirements of

Topic 740 on income taxes, when determining the carrying amount of an entity (or a reporting unit), deferred income taxes shall be included in the carrying amount of an entity (or the reporting unit), regardless of whether the fair value of the entity (or the reporting unit) will be determined assuming it would be bought or sold in a taxable or nontaxable transaction.

350-20-35-77 The goodwill impairment loss, if any, shall be allocated to individual amortizable units of goodwill of the entity (or the reporting unit) on a pro rata basis using their relative carrying amounts or using another reasonable and rational basis.

350-20-35-78 After a goodwill impairment loss is recognized, the adjusted carrying amount of goodwill shall be its new accounting basis, which shall be amortized over the remaining useful life of goodwill. Subsequent reversal of a previously recognized goodwill impairment loss is prohibited.

> > Interaction of the Impairment Tests for Goodwill and Other Assets (or Asset Groups)

350-20-35-79 If goodwill and another asset (or asset group) of the entity (or the reporting unit) are tested for impairment at the same time, the other asset (or asset group) shall be tested for impairment before goodwill. For example, if a significant asset group is to be tested for impairment under the Impairment or Disposal of Long-Lived Assets Subsections of

Subtopic 360-10 on property, plant, and equipment (thus potentially requiring a goodwill impairment test), the impairment test for the significant asset group would be performed before the goodwill impairment test. If the asset group is impaired, the impairment loss would be recognized prior to goodwill being tested for impairment.

350-20-35-80 The requirement in the preceding paragraph applies to all assets that are tested for impairment, not just those included in the scope of the Impairment or Disposal of Long-Lived Assets Subsections of

Subtopic 360-10.

> Equity Method Investments

350-20-35-81 The portion of the difference between the cost of an investment and the amount of underlying equity in net assets of an equity method investee that is recognized as goodwill in accordance with paragraph 323-10-35-13 (equity method goodwill) shall be amortized on a straight-line basis over 10 years, or less than 10 years if the entity demonstrates that another useful life is more appropriate.

350-20-35-82 However, equity method goodwill shall not be reviewed for impairment in accordance with this Subtopic. Equity method investments shall continue to be reviewed for impairment in accordance with paragraph 323-10-35-32.

5. Amend paragraphs 350-20-40-2 through 40-7 and 350-20-40-9, with no link to a transition paragraph, as follows:

Derecognition

General

> Disposal of All or a Portion of a Reporting Unit

350-20-40-1 When a reporting unit is to be disposed of in its entirety, goodwill of that reporting unit shall be included in the carrying amount of the reporting unit in determining the gain or loss on disposal.

350-20-40-2 When a portion of a reporting unit that constitutes a business (see

Section 805-10-55)

or nonprofit activity is to be disposed of, goodwill associated with that business

or nonprofit activity shall be included in the carrying amount of the business

or nonprofit activity in determining the gain or loss on disposal.

350-20-40-3 The amount of goodwill to be included in that carrying amount shall be based on the relative fair values of the business

or nonprofit activity to be disposed of and the portion of the reporting unit that will be retained. For example, if a

reporting unit with a fair value of $400 is selling a business

or nonprofit activity is being sold

for $100 and the fair value of the reporting unit excluding the business

or nonprofit activity being sold is $300, 25 percent of the goodwill residing in the reporting unit would be included in the carrying amount of the business

or nonprofit activity to be sold.

350-20-40-4 However, if the business or nonprofit activity to be disposed of was never integrated into the reporting unit after its acquisition and thus the benefits of the acquired goodwill were never realized by the rest of the reporting unit, the current carrying amount of that acquired goodwill shall be included in the carrying amount of the business or nonprofit activity to be disposed of.

350-20-40-5 That situation might occur when the acquired business or nonprofit activity is operated as a standalone entity or when the business or nonprofit activity is to be disposed of shortly after it is acquired.

350-20-40-6 Situations in which the acquired business or nonprofit activity is operated as a standalone entity are expected to be infrequent because some amount of integration generally occurs after an acquisition.

350-20-40-7 When only a portion of goodwill is allocated to a business or nonprofit activity to be disposed of, the goodwill remaining in the portion of the reporting unit to be retained shall be tested for impairment in accordance with paragraphs 350-20-35-3A through 35-19 using its adjusted carrying amount.

Pending Content:

Transition Date: (P) December 16, 2019; (N) December 16, 2021 I Transition Guidance: 350-20-65-3

350-20-40-7 When only a portion of goodwill is allocated to a business or nonprofit activity to be disposed of, the goodwill remaining in the portion of the reporting unit to be retained shall be tested for impairment in accordance with paragraphs 350-20-35-3A through 35-13 using its adjusted carrying amount.

Accounting Alternative

350-20-40-8 The following guidance for goodwill applies to entities within the scope of paragraph 350-20-15-4 that elect the accounting alternative for the subsequent measurement of goodwill.

> Disposal of a Portion of an Entity (or a Reporting Unit)

350-20-40-9 When a portion of an entity (or a reporting unit) that constitutes a business or nonprofit activity is to be disposed of, goodwill associated with that business or nonprofit activity shall be included in the carrying amount of the business or nonprofit activity in determining the gain or loss on disposal. An entity shall use a reasonable and rational approach to determine the amount of goodwill associated with the business or nonprofit activity to be disposed of.

6. Amend paragraph 350-20-45-6, with no link to a transition paragraph, as follows:

Other Presentation Matters

Accounting Alternative

350-20-45-4 The following guidance for goodwill applies to entities within the scope of paragraph 350-20-15-4 that elect the accounting alternative for the subsequent measurement of goodwill.

350-20-45-5 The aggregate amount of goodwill net of accumulated amortization and impairment shall be presented as a separate line item in the statement of financial position.

350-20-45-6 The amortization and aggregate amount of impairment of goodwill shall be presented in income statement or statement of activities line items within continuing operations (or similar caption) unless the amortization or a goodwill impairment loss is associated with a discontinued operation.

350-20-45-7 The amortization and impairment of goodwill associated with a discontinued operation shall be included (on a net-of-tax basis) within the results of discontinued operations.

7. Amend paragraphs 350-20-50-4 and 350-20-50-6 through 50-7, with no link to a transition paragraph, as follows:

Disclosure

Accounting Alternative

> Disclosures about Additions to Goodwill

350-20-50-4 The following information shall be disclosed in the notes to financial statements for any additions to goodwill in each period for which a statement of financial position is presented:

- The amount assigned to goodwill in total and by major business combination, by major acquisition by a not-for-profit entity, or by reorganization event resulting in fresh-start reporting

- The weighted-average amortization period in total and the amortization period by major business combination, by major acquisition by a not-for-profit entity, or by reorganization event resulting in fresh-start reporting.

> Information for Each Period for Which a Statement of Financial Position Is Presented

350-20-50-5 The following information shall be disclosed in the financial statements or the notes to the financial statements for each period for which a statement of financial position is presented:

- The gross carrying amounts of goodwill, accumulated amortization, and accumulated impairment loss

- The aggregate amortization expense for the period

- Goodwill included in a disposal group classified as held for sale in accordance with paragraph 360-10-45-9 and goodwill derecognized during the period without having previously been reported in a disposal group classified as held for sale.

> Goodwill Impairment Loss

350-20-50-6 For each goodwill impairment loss recognized, the following information shall be disclosed in the notes to financial statements that include the period in which the impairment loss is recognized:

- A description of the facts and circumstances leading to the impairment

- The amount of the impairment loss and the method of determining the fair value of the entity or the reporting unit (whether based on prices of comparable businesses or nonprofit activities, a present value or other valuation technique, or a combination of those methods)

- The caption in the income statement or statement of activities in which the impairment loss is included

- The method of allocating the impairment loss to the individual amortizable units of goodwill.

350-20-50-7 The quantitative disclosures about significant unobservable inputs used in fair value measurements categorized within Level 3 of the fair value hierarchy required by paragraph 820-10-50-2(bbb) are not required for fair value measurements related to the financial accounting and reporting for goodwill after its initial recognition in a business combination or an acquisition by a not-for-profit entity.

Implementation Guidance and Illustrations

Accounting Alternative

> Implementation Guidance

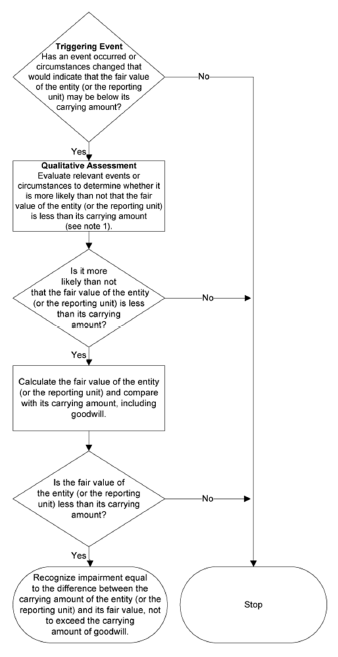

350-20-55-26 The following flowchart provides an overview of the accounting alternative for entities within the scope of paragraph 350-20-15-4.

Note 1:

An entity has the unconditional option to skip the qualitative assessment and proceed directly to calculating the fair value of the entity (or the reporting unit) and comparing that value with its carrying amount, including goodwill.

Pending Content:

Transition Date: (P) December 16, 2019; (N) December 16, 2021 I Transition Guidance: 350-20-65-3

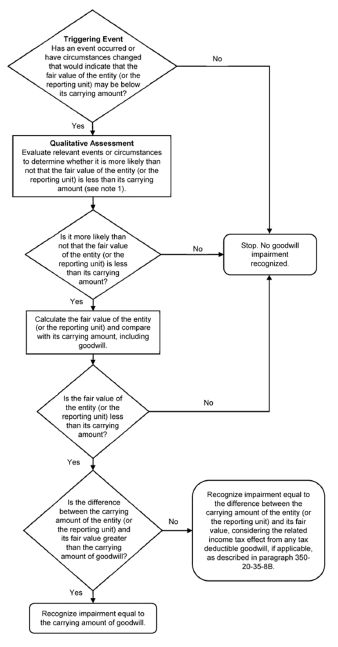

The following flowchart provides an overview of the accounting alternative for entities within the scope of paragraph 350-20-15-4.

Note 1:

An entity has the unconditional option to skip the qualitative assessment and proceed directly to calculating the fair value of the entity (or the reporting unit) and comparing that value with its carrying amount, including goodwill.

8. Amend paragraph 350-20-65-2 and its related heading as follows:

Transition and Open Effective Date Information

> Transition Related to Accounting Standards Update

Updates No. 2014-02, Intangibles—Goodwill and Other (Topic 350): Accounting for Goodwill, and No. 2019-06, Intangibles—Goodwill and Other (Topic 350), Business Combinations (Topic 805), and Not-for-Profit Entities (Topic 958): Extending the Private Company Accounting Alternatives on Goodwill and Certain Identifiable Intangible Assets to Not-for-Profit Entities

350-20-65-2 The following represents the transition information related to Accounting Standards

Update

Updates No. 2014-02,

Intangibles—Goodwill and Other (Topic 350): Accounting for Goodwill, and No. 2019-06, Intangibles— Goodwill and Other (Topic 350), Business Combinations (Topic 805), and Not-for-Profit Entities (Topic 958): Extending the Private Company Accounting Alternatives on Goodwill and Certain Identifiable Intangible Assets to Not-for-Profit Entities, referenced in paragraph 350-20-15-3A:

- Upon adoption of the guidance in the Accounting Alternative Subsections of this Subtopic and the guidance in paragraph 323-10-35-13, that guidance shall be effective prospectively for new goodwill recognized after the adoption of that guidance. For existing goodwill, that guidance shall be effective as of the beginning of the first fiscal year in which the accounting alternative is adopted.

- Goodwill existing as of the beginning of the period of adoption shall be amortized prospectively on a straight-line basis over 10 years, or less than 10 years if an entity demonstrates that another useful life is more appropriate.

- Subparagraph superseded by Accounting Standards Update No. 2016-03.

- Upon adoption of the accounting alternative, an entity shall make an accounting policy election to test goodwill for impairment at either the entity level or the reporting unit level.

- A private company or not-for-profit entity that makes an accounting policy election to apply the guidance in the Accounting Alternative Subsections of this Subtopic for the first time need not justify that the use of the accounting alternative is preferable as described in paragraph 250-10-45-2.