Search within this section

Select a section below and enter your search term, or to search all click Financial statement presentation

Favorited Content

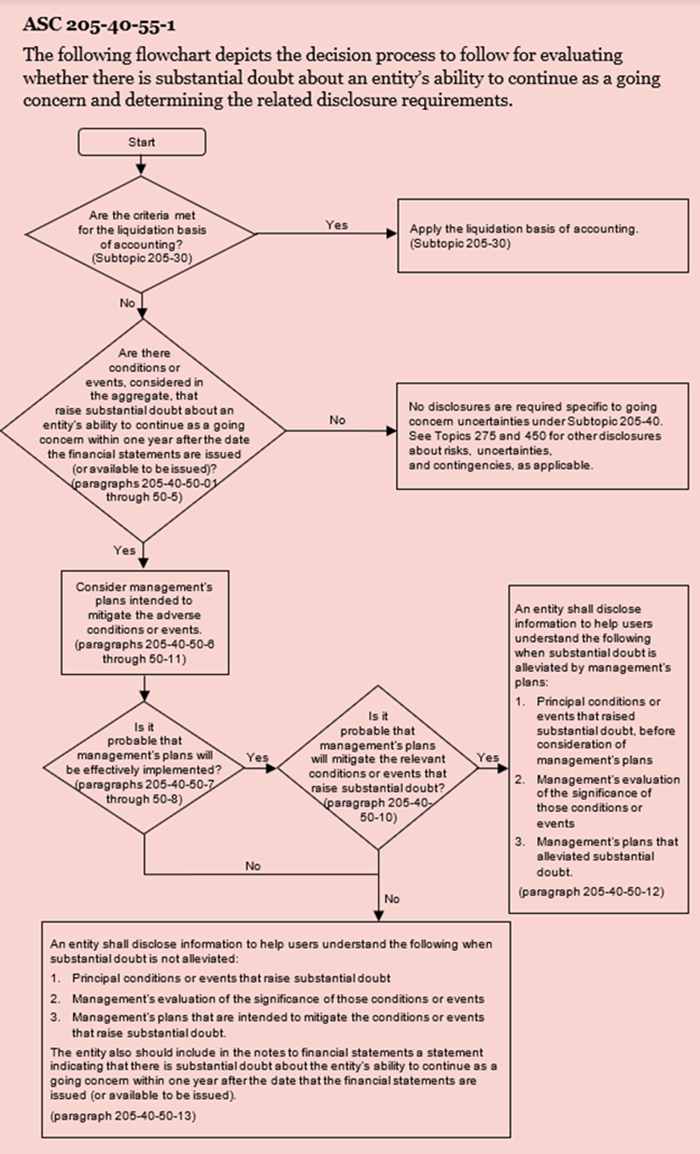

View image

View image

Definition of Substantial Doubt from ASC Master Glossary

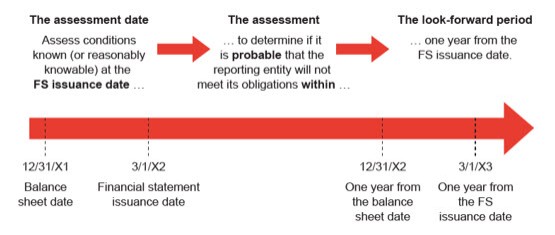

Substantial doubt about an entity’s ability to continue as a going concern exists when conditions and events, considered in the aggregate, indicate that it is probable that the entity will be unable to meet its obligations as they become due within one year after the date that the financial statements are issued (or within one year after the date that the financial statements are available to be issued when applicable).

View image

View image

When evaluating an entity’s ability to meet its obligations, management shall consider quantitative and qualitative information about the following conditions and events, among other relevant conditions and events known and reasonably knowable at the date that the financial statements are issued:

Excerpt from ASC 205-40-55-2

Required disclosures |

|

As discussed in ASC 205-40-50-12, if the initially-identified substantial doubt is alleviated by management’s plans, disclose: |

As discussed in ASC 205-40-50-13, if the substantial doubt is not alleviated by management’s plans, disclose: |

|

|

|

|

|

|

|

|

Relevant conditions |

Management’s assessment results |

Management's plans to mitigate adverse conditions |

Do conditions raise substantial doubt? |

Is substantial doubt alleviated by management’s plans? |

Disclosures |

Negative financial trends No significant debt coming due within the assessment period Substantial liquid resources (cash and line of credit) |

Cash flow forecasts demonstrate the reporting entity will meet its obligations within the assessment period |

Cost cutting measures |

No, because it is not probable that the entity will be unable to meet obligations within the next year |

N/A |

No disclosures specific to going concern required |

Negative financial trends No significant debt coming due within the assessment period Limited liquid resources (cash and line of credit) |

Cash flow forecasts demonstrate the reporting entity will run out of cash (and available line of credit) within the assessment period |

Sell Division A – Plan approved by the board before the issuance date and it is probable within the assessment period that the plan:

|

Yes, because it is probable that the entity will not meet obligations within the next year – unless it sells Division A. |

Yes |

Disclose conditions, management’s evaluation, and management’s plans that alleviated substantial doubt |

Positive financial trends and positive working capital Significant debt is coming due within the next year The reporting entity does not have the ability to repay all debt at maturity The reporting entity has a history of refinancing debt and nothing indicates it cannot refinance again |

Absent a refinancing, the reporting entity would not be able to meet its obligations within the next yearWith refinancing, it would meet its obligations |

Refinance debt The plan is deemed to be probable of being implemented and probable of mitigating adverse conditions |

Yes, because it is probable that the entity will not meet its obligations within the next year – unless it refinances |

Yes |

Limited incremental disclosures: refer to debt footnote, mention the plan to refinance |

Negative financial trends and limited liquidity Significant debt is coming due within the next year The reporting entity does not have the ability to repay all debt at maturity The reporting entity does not have a history of refinancing debt |

Absent a refinancing, the reporting entity will not meet its obligations within the next year With refinancing, it would meet its obligations |

Refinance debt Plan is not probable of being implemented due to negative financial trends and lack of refinancing history |

Yes, because it is probable that the entity will not meet its obligations within the next year – unless it refinances |

No |

Express that there is substantial doubt. Also disclose conditions, management’s evaluation, and management’s plans. |

PwC. All rights reserved. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Select a section below and enter your search term, or to search all click Financial statement presentation