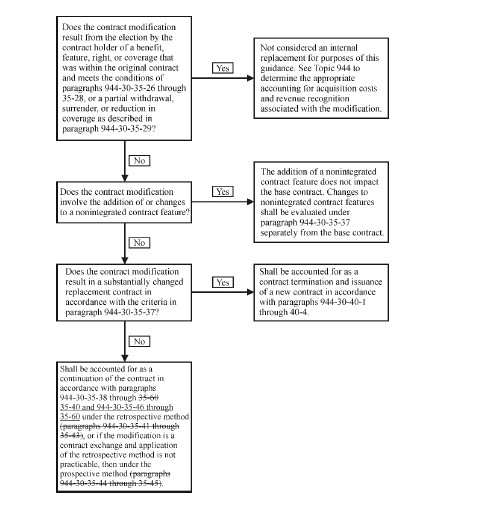

10. Amend paragraphs 944-40-15-6, 944-40-25-11 and its related heading, 94440-25-25 and the related heading, 944-40-25-26 through 25-27 and their related heading, and 944-40-25-40 through 25-41, supersede paragraphs 944-40-25-25A and its related heading and 944-40-25-28 and its related heading, and add paragraphs 944-40-25-25B through 25-25D and their related headings and 944-40-25-27A and its related heading, with a link to transition paragraph 944-40-65-2, as follows:

Financial Services—Insurance—Claim Costs and Liabilities for Future Policy Benefits

Scope and Scope Exceptions

Long-Duration Contracts

> Instruments

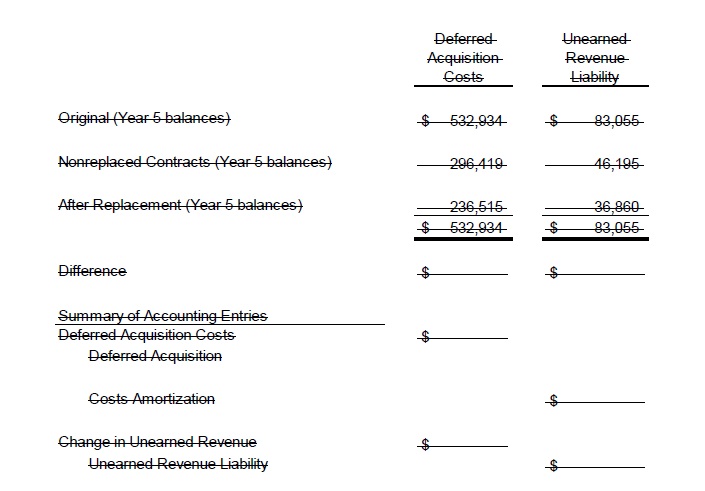

944-40-15-6 The guidance in the Long-Duration Contracts Subsections of this Subtopic applies

only

to long-duration

contracts.

contracts, including investment contracts with respect to nontraditional contract benefits referenced in paragraph 944-40-25-25B. See the Long-Duration Contracts Subsection of Section 944-20-15 for a discussion of what constitutes a long-duration contract.

Recognition

Long-Duration Contracts

> Overall

944-40-25-7 A liability for expected costs relating to most types of long-duration contracts shall be accrued over the current and expected renewal periods of the contracts.

944-40-25-8 The present value of estimated future policy benefits to be paid to or on behalf of policyholders less the present value of estimated future net premiums to be collected from policyholders—that is, a liability for future policy benefits— shall be accrued when premium revenue is recognized.

944-40-25-9 In addition, as discussed in paragraph 944-40-25-1 liabilities for unpaid claims and claim adjustment expenses shall be accrued when insured events occur.

944-40-25-10 A liability for future policy benefits relating to long-duration contracts other than title insurance contracts shall be accrued when premium revenue is recognized.

> Traditional and Limited-Payment Long-Duration Contracts

944-40-25-11 The liability for future policy benefits

representscan be viewed as either of the following: The

the present value of future benefits to be paid to or on behalf of policyholders and

certain related expenses less the present value of future net premiums

receivablepayable

under the insurance contracts

. In no event shall net premiums exceed gross premiums. [Content amended as shown and moved from (a)]

a. Subparagraph superseded by

Accounting Standards Update No. 2018-12 The present value of future benefits to be paid to or on behalf of policyholders and expenses less the present value of future net premiums payable under the insurance contracts

[Content amended and moved above]b.

Subparagraph superseded by Accounting Standards Update No. 2018-12.The accumulated amount of net premiums already collected less the accumulated amount of benefits and expenses already paid to or on behalf of policyholders

.

> Universal Life-Type Contracts and Nontraditional Contract Benefits

> > Balance That Accrues to the Benefit of Policyholders

> > > Contracts with Surrender Adjustments

944-40-25-25 The accrued account balance shall not reflect surrender adjustments (for example,

market value annuity adjustments, surrender charges, or credits). For a description of a market value annuity and market value annuity adjustments, see paragraph 944-20-05-28.

Example 1 (see paragraph 944-40-556) illustrates the calculation of the liability for future policy benefits for a contract with a minimum guaranteed death benefit.

> > Universal Life-Type Contracts with Death or Other Insurance Benefit Features

> > Additional Liability

944-40-25-25B The following guidance addresses contracts or contract features that provide for potential benefits in addition to the account balance:

a. An insurance entity shall first determine at contract inception whether such benefits should be accounted for under the provisions of paragraph 944-40-25-25C.

b. For benefits that are not accounted for under the provisions of paragraph 944-40-25-25C, anAn

insurance entity shall

thenfirst

determine whether such

benefitscontract

features should be accounted for under the provisions of Subtopic 815-10 or 815-15.

[Content amended as shown and moved from paragraph 944-40-25-26]

c. All other benefits shall be accounted for under the provisions of paragraphs 944-40-25-26 through 25-27A, as applicable.

> > > Market Risk Benefits

944-40-25-25C A contract or contract feature that both provides protection to the contract holder from other-than-nominal capital market risk and exposes the insurance entity to other-than-nominal capital market risk shall be recognized as a market risk benefit.

944-40-25-25D In evaluating whether a contract or contract feature meets the conditions in paragraph 944-40-25-25C, an insurance entity shall consider that:

a. Protection refers to the transfer of a loss in, or shortfall (that is, the difference between the account balance and the benefit amount) of, the contract holder’s account balance from the contract holder to the insurance entity, with such transfer exposing the insurance entity to capital market risk that would otherwise have been borne by the contract holder (or beneficiary).

b. Protection does not include the death benefit component of a life insurance contract (that is, the difference between the account balance and the death benefit amount). This condition does not apply to an investment contract or an annuity contract (including an annuity contract classified as an insurance contract).

c. A nominal risk, as explained in paragraph 944-20-15-21, is a risk of insignificant amount or a risk that has a remote probability of occurring. A market risk benefit is presumed to expose the insurance entity to otherthan- nominal capital market risk if the benefit would vary more than an insignificant amount in response to capital market volatility.

> > >> > Contracts with

Annuitization Benefits

944-40-25-26 This guidance addresses contract features that provide for potential benefits in addition to the account balance that are payable only upon

{add glossary link}annuitization,

{add glossary link} such as annuity purchase

guarantees,

guarantees or {add glossary link}guaranteed minimum income benefits

{add glossary link} that are not market risk benefits, and two-tier annuities.

An insurance entity shall first determine whether such contract features should be accounted for under the provisions of Subtopic 815-10 or 815-15.

[Content amended and moved to paragraph 944-40-25-25B(b)]

944-40-25-27 If the contract feature is not required to be accounted for under

paragraph 944-40-25-25C or the provisions of

Topic 815 on derivatives and hedging Subtopic 815-10 or 815-15

, an additional liability for the contract feature shall be established if the present value of expected annuitization payments at the expected annuitization date exceeds the expected account balance at the expected annuitization date.

> > > Death or Other Insurance Benefits

944-40-25-27A If the contract feature is not required to be accounted for under paragraph 944-40-25-25C or the provisions of Topic 815 on derivatives and hedging and if If

the amounts assessed against the contract holder each period for the insurance benefit feature of an insurance contract are assessed in a manner that is expected to result in profits in earlier years and losses in subsequent years from the insurance benefit function, a liability for

death or other insurance benefits unearned revenue

shall be recognized in addition to the account balance.

[Content amended as shown and moved from paragraph 944-605-25-8]

> Limited-Payment Contracts

944-40-25-28 Paragraph superseded by Accounting Standards Update No. 2018-12.For limited-payment contracts, the liability for policy benefits shall be established in accordance with the guidance beginning in paragraph 944-40-25-7.

Reinsurance Contracts

944-40-25-40 A reinsurer may agree to reinsure all or a portion of certain

{add glossary link}annuitization

{add glossary link} or death or other insurance benefits (see paragraphs

944-40-25-26 through 25-27

944-40-25-25B through 25-27A). Both the

ceding entity and the reinsurer shall first determine whether such a reinsurance contract should be accounted for under the

market risk benefit provisions of

paragraph 944-40-25-25CSubtopic 815-10 or 815-15. For example, unlike many of the direct contracts that contain guaranteed minimum income benefits, contracts to reinsure guaranteed minimum income benefits often meet the definition of a derivative instrument under Subtopic 815-10

.

For reinsurers, the reference to the account balance in paragraph 944-40-25-25D refers to the underlying contract between the direct writer and the contract holder. If the reinsurance contract is not accounted for under the market risk benefit provisions of paragraph 944-40-25-25C, both the ceding entity and the reinsurer shall then determine whether such a reinsurance contract should be accounted for under the provisions of Subtopic 815-10 or 815-15.

944-40-25-41 If the reinsurance contract is not required to be accounted for under the provisions of

paragraph 944-40-25-25C or Subtopic 815-10 or 815-15, the entity shall apply the guidance in

paragraphs 944-40-25-26 through 25-27A.paragraph 944-40-25-27

11. Supersede paragraphs 944-40-30-6, 944-40-30-10, 944-40-30-19A, and 944-40-30-25, amend paragraphs 944-40-30-7 through 30-9 and the related headings, 944-40-30-13 through 30-16 and the related heading, 944-40-30-19, the heading preceding paragraph 944-40-30-19A, 944-40-30-20, 944-40-30-22, 944-40-30-24, 944-40-30-26 through 30-27 and their related heading, and 944-40-30-29 through 30-30, and add paragraphs 944-40-30-7A, 944-40-30-19B through 19D and the related heading, the heading preceding paragraph 944-40-30-20, 944-40-30-22A, and 944-40-30-29A and its related heading, with a link to transition paragraph 944-40-65-2, as follows:

Initial Measurement

Long-Duration Contracts

> Overall

944-40-30-6 Paragraph superseded by Accounting Standards Update No. 2018-12.Estimates for purposes of recognizing the liability for future policy benefits under paragraph 944-40-25-8 shall be based on assumptions, such as estimates of expected investment yields, mortality, morbidity, terminations, and expenses, applicable at the time the insurance contracts are made.

> Traditional and Limited-Payment Long-Duration Contracts

944-40-30-7 The

{add glossary link}liability for future policy benefits

{add glossary link} accrued under paragraph

944-40-25-10

944-40-25-8 shall be the present value of future benefits to be paid to or on behalf of policyholders and related expenses less the present value of future

net premiums (portion of

gross premium required to provide for all benefits and

expenses).

expenses, excluding acquisition costs or costs that are required to be charged to expense as incurred). That liability shall be estimated using methods that include assumptions, such as

discount rateestimates of expected investment yields

,

{add glossary link}mortality

{add glossary link},

{add glossary link}morbidity

{add glossary link},

{add glossary link}terminations

{add glossary link}, and expenses

(see paragraphs 944-40-30-9 and 944-40-30-11 through 30-15) applicable at the time the insurance contracts are made

. The liability also shall consider other assumptions relating to guaranteed contract benefits, such as coupons, annual endowments, and conversion privileges. The assumptions shall

not include

a provision for the

risk of adverse deviation.

In determining the level of aggregation at which reserves are calculated, an insurance entity shall not group contracts together from different issue years but shall group contracts into quarterly or annual groups.

944-40-30-7A To the extent the present value of future benefits and expenses exceeds the present value of future gross premiums, an immediate charge shall be recognized in net income (see paragraph 944-40-45-4) such that net premiums are set equal to gross premiums. In no event shall the liability for future policy benefits balance be less than zero for the level of aggregation at which reserves are calculated. Assumptions shall be updated in subsequent accounting periods as described in paragraphs 944-40-35-5 through 35-6A and 944-40-35-7A through 35-7B.

> > Assumptions

944-40-30-8 This guidance discusses the following assumptions:

a.

Investment yields

Discount rateb. Mortality

c. Morbidity

d. Termination

e. Expense.

> > > Investment Yields

Discount Rate

944-40-30-9 Interest assumptions used in estimating the liability for future policy benefits shall be based on estimates of investment yields (net of related investment expenses) expected at the time insurance contracts are made.

The liability for future policy benefits shall be discounted using an upper-medium grade (low-credit-risk) fixed-income instrument yield. An insurance entity shall consider reliable information in estimating the upper-medium grade (low-credit-risk) fixed-income instrument yield that reflects the duration characteristics of the liability for future policy benefits (see paragraph 944-40-55-13E). An insurance entity shall maximize the use of relevant observable inputs and minimize the use of unobservable inputs in determining the discount rate assumption.

944-40-30-10 Paragraph superseded by Accounting Standards Update No. 2018-12.The interest assumption for each block of new insurance contracts shall be consistent with circumstances, such as actual yields, trends in yields, portfolio mix and maturities, and the entity's general investment experience.

> > > Mortality

944-40-30-11 Mortality assumptions used in estimating the liability for future policy benefits shall be based on estimates of expected mortality.

> > > Morbidity

944-40-30-12 Morbidity assumptions used in estimating the liability for future policy benefits shall be based on estimates of expected incidences of disability and claim costs.

944-40-30-13 Expected incidences of disability and claim costs for various types of insurance (for example, noncancelable and guaranteed renewable accident and health insurance contracts) and other factors, such as occupational class, waiting period, sex, age, and benefit period, shall be considered in making morbidity assumptions. The risk of antiselection or adverse selection also shall be considered in making morbidity assumptions.

> > > Termination

944-40-30-14 Termination assumptions used in estimating the liability for future policy benefits shall be based on

estimates of expectedanticipated

terminations and

nonforfeiture benefits, using

expectedanticipated

termination rates and contractual nonforfeiture benefits. Termination rates may vary by plan of insurance, age at issue, year of issue, frequency of premium payment, and other factors. If composite rates are used, the rates shall be representative of the entity's actual mix of business. Termination assumptions shall be made for long-duration insurance contracts without termination benefits because of the effects of terminations on

expectedanticipated

premiums and claim costs.

> > > Expense

944-40-30-15 Expense assumptions used in estimating the liability for future policy benefits shall be based on estimates of expected nonlevel costs, such as termination or settlement costs, and costs after the premium-paying period. Renewal expense assumptions shall consider the possible effect of inflation on those expenses. However, expense assumptions shall not include acquisition costs or any costs that are required to be charged to expense as incurred, such as those relating to investments, general administration, policy maintenance costs, product development, market research, and general overhead (see paragraph 944-720-25-2).

> Universal Life-Type Contracts and Nontraditional Contract Benefits

944-40-30-16 The liability for policy benefits for universal life-type contracts shall be equal to the sum of

all of

the following:

a. The balance that accrues to the benefit of policyholders at the date of the financial statements

b. Any amounts that have been assessed to compensate the

insurance entity insurer

for services to be performed over future periods (see

paragraphs 944-605-25-6 through 25-7

Subtopic 944-605 on insurance— revenue recognition)

c. Any amounts previously assessed against policyholders that are refundable on termination of the contract

d. Any probable loss (premium deficiency) as described in paragraphs 944- 60-25-7 through 25-9.

944-40-30-17 Amounts that may be assessed against policyholders in future periods, including surrender charges, shall not be anticipated in determining the liability for policy benefits.

944-40-30-18 In the absence of a stated account balance or similar explicit or implicit contract value, the cash value, measured at the date of the financial statements, that could be realized by a policyholder upon surrender shall represent the element of liability described in paragraph 944-40-30-16(a).

944-40-30-19 Provisions for risk of adverse deviation shall not be made.

> > Additional LiabilityUniversal Life-Type Contracts with Death or Other Insurance Benefit Features

944-40-30-19B The guidance in paragraphs 944-40-30-19C through 30-24 and 944-40-30-26 through 30-29A addresses contracts or contract features that provide for potential benefits in addition to the account balance that accrues to the benefit of the policyholders.

> > > Market Risk Benefits

944-40-30-19C A market risk benefit shall be measured at fair value. Total attributed fees used to calculate the fair value of the market risk benefit shall not be negative or exceed total contract fees and assessments collectible from the contract holder.

944-40-30-19D In determining the terms of the market risk benefit, the insurance entity shall consider guidance on determining the terms of an embedded derivative that is required to be accounted for separately under Subtopic 815-15 on embedded derivatives, including the following:

a. Consistent with paragraph 815-15-30-4, if a nonoption valuation approach is used, the terms of the market risk benefit shall be determined in a manner that results in its fair value generally being equal to zero at the inception of the contract.

b. Consistent with paragraph 815-15-30-6, if an option-based valuation approach is used, the terms of the market risk benefit shall not be adjusted to result in the market risk benefit being equal to zero at the inception of the contract.

c. Consistent with paragraph 815-15-25-7, if a contract contains multiple market risk benefits, those market risk benefits shall be bundled together as a single compound market risk benefit.

> > > Death or Other Insurance Benefits

944-40-30-20 The amount of the additional liability recognized under paragraph

944-40-25-25A

944-40-25-27A shall be determined based on the ratio (benefit ratio) of the following:

a. Numerator. The present value of total expected excess payments over the life of the contract, discounted at the contract rate

b. Denominator. The present value of total expected assessments over the life of the contract, discounted at the contract rate.

Total expected assessments are the aggregate of all charges, including those for administration, mortality, expense, and surrender, regardless of how characterized.

The contract rate used to compute present value shall be either the rate in effect at the inception of the book of contracts or the latest revised rate applied to the remaining benefit period. The approach selected to compute the present value of revised estimates shall be applied consistently in subsequent revisions to computations of the benefit ratio.

944-40-30-21 The benefit ratio as determined in the preceding paragraph may exceed 100 percent, resulting in a liability that exceeds cumulative assessments.

944-40-30-22 For contracts in which the assets are reported in the

general account and that include investment margin in their estimated gross profits

, the investment margin

(that is, the amounts expected to be earned from the investment of policyholder balances less amounts credited to policyholder balances [see paragraph 944-40-25-14]) shall be included with any other assessments for purposes of determining total expected assessments

that are referenced in paragraph 944-40-30-20.

944-40-30-22A An increase during a period in an unearned revenue liability (that is, deferral of revenue) established in paragraphs 944-605-25-6 through 25-7 shall be excluded from the amounts assessed against the contract holder’s account balance for that period and a decrease in (that is, amortization of) an unearned revenue liability in accordance with paragraph 944-605-35-2 during a period shall be included with the assessments for that period. [Content amended as shown and moved from paragraph 944-605-25-11]

944-40-30-23 The insurance entity shall calculate the present value of total expected excess payments and total assessments and investment margins, as applicable, based on expected experience.

944-40-30-24 Expected experience shall be based on a range of scenarios that considers the volatility inherent in the assumptions rather than a single set of best estimate assumptions.

944-40-30-25 Paragraph superseded by Accounting Standards Update No. 2018-12.In calculating the additional liability for the insurance benefit feature, assumptions used, such as the interest rate, discount rate, lapse rate, and mortality, shall be consistent with assumptions used in estimating gross profits for purposes of amortizing capitalized acquisition costs.

> > > > > Universal Life-Type Contracts with

Annuitization Benefits

944-40-30-26 The additional liability required under paragraph 944-40-25-27 shall be measured initially based on the benefit ratio determined by the following numerator and denominator:

a. Numerator. The present value of expected

{add glossary link}annuitization

{add glossary link} payments to be made and related incremental

claim adjustment expenses, discounted at

an uppermedium grade (low-credit-risk) fixed-income instrument yield applicable toestimated investment yields expected to be earned during

the

payout phase of the contract, minus the expected accrued account balance at the expected annuitization date (the excess payments).

The excess of the present value payments to be made during the payout phase of the contract over the expected accrued account balance at the expected annuitization date shall be discounted at the contract rate.b. Denominator. The present value of total expected assessments during the accumulation phase of the contract, discounted at the contract rate.

Total expected assessments are the aggregate of all charges, including those for administration, mortality, expense, and surrender, regardless of how characterized.

944-40-30-27 For contracts whose assets are reported in the general account

and that include investment margin in their estimated gross profits

, the investment margin

(that is, the amounts expected to be earned from the investment of policyholder balances less amounts credited to policyholder balances [see paragraph 944-40-25-14]) shall be included with any other assessments for purposes of determining total expected assessments that are referenced in paragraph 944-40-30-26.

944-40-30-28 The insurance entity shall calculate the present value of total expected excess payments and total assessments and investment margins, as applicable, based on expected experience. Expected experience shall be based on a range of scenarios that considers the volatility inherent in the assumptions rather than a single set of best estimate assumptions. When determining expected excess payments, the expected annuitization rate is one of the assumptions that needs to be estimated.

944-40-30-29 In calculating the additional liability for the additional benefit feature,

assumptions used, such as the interest rate, discount rate, lapse rate, and mortality, shall be consistent with assumptions used in estimating gross profits for purposes of amortizing capitalized acquisition costs under the Long-Duration Contracts Subsection of Section 944-30-35

the contract rate used to compute present value shall be either the rate in effect at the inception of the book of contracts or the latest revised rate applied to the remaining benefit period. The approach selected to compute the present value of revised estimates shall be applied consistently in subsequent revisions to computations of the benefit ratio.

> > > Insurance Benefit Feature That Wraps a Noninsurance Contract

944-40-30-29A A reinsurer or issuer of the insurance benefit features of a contract shall calculate a liability for the portion of premiums collected each period that represents compensation to the insurance entity for benefits that are assessed in a manner that is expected to result in current profits and future losses from the insurance benefit function. That liability shall be calculated using the methodology described in paragraphs 944-40-30-19B through 30-24 and 944-40-30-26 through 30-29.

> Certain Participating Life Insurance Contracts—Net Level Premium Reserve

944-40-30-30 The net level premium reserve shall be calculated based on the dividend fund interest rate, if determinable, and mortality rates guaranteed in calculating the {add glossary link}cash surrender values{add glossary link} described in the contract. If the dividend fund interest rate is not determinable, the guaranteed interest rate used in calculating cash surrender values described in the contract shall be used. If the dividend fund interest rate is not determinable and there is no guaranteed interest rate, the interest rate used in determining guaranteed nonforfeiture values shall be used. Finally, if none of the above rates exists, then the interest rate used to determine minimum cash surrender values— as set by the National Association of Insurance Commissioners' model standard nonforfeiture law—for the year of issue of the contract should be used. Regardless of the rate used, net premiums shall be calculated as a constant percentage of the gross premiums.

12. Amend paragraphs 944-40-35-5 through 35-6 and their related heading, the heading preceding paragraph 944-40-35-8, 944-40-35-9 and its related heading, 944-40-35-12 and its related heading, 944-40-35-15 through 35-16, the heading preceding paragraph 944-40-35-17, 944-40-35-18, and 944-40-35-20 through 3523 and the related heading, add paragraphs 944-40-35-6A, 944-40-35-7A through 35-7B, and 944-40-35-8A through 35-8B and their related headings, and supersede paragraphs 944-40-35-7 through 35-8, 944-40-35-11, and 944-40-3524, with a link to transition paragraph 944-40-65-2, as follows:

Subsequent Measurement

Long-Duration Contracts

> Traditional and Limited-Payment Long-Duration Contracts

944-40-35-5

Original assumptions shall continue to be used

Assumptions shall be updated in subsequent accounting periods

as follows to determine changes in the

liability for future policy benefits:liability for future policy benefits (often referred to as the lock-in concept) unless a premium deficiency exists subject to paragraphs 944-60-25-7 through 25-9.

a. Cash flow assumptions (that is, the assumptions used to derive estimated cash flows, including the mortality, morbidity, termination, and expense assumptions referenced in paragraphs 944-40-30-11 through 30-15) shall be reviewed—and if there is a change, updated—on an annual basis, at the same time every year1

1. Cash flow assumptions shall be updated in interim reporting periods if evidence suggests that cash flow assumptions should be revised.

2. An insurance entity may make an entity-wide election not to update the expense assumption referenced in paragraph 944-40-30-15.

b. The discount rate assumption referenced in paragraph 944-40-30-9 shall be updated for annual and interim reporting periods, as of the reporting date.

944-40-35-6 Actual experience shall be recognized in the period in which that experience arises. The liability for future policy benefits shall then be updated for actual experience at least on an annual basis as described in paragraph 944-40-35-5(a) (and for limited-payment contracts, see paragraph 944-605-35-1B for guidance on updating any corresponding deferred profit liability). An insurance entity need not update the liability for future policy benefits for actual experience more often than on an annual basis, unless cash flow assumptions are updated as described in paragraph 944-40-35-5(a)(1).Changes in the liability for future policy benefits that result from its periodic estimation for financial reporting purposes shall be recognized in income in the period in which the changes occur.

944-40-35-6A A related charge or credit to net income (see paragraph 944-40-45-4) or other comprehensive income as a result of updating assumptions at the level of aggregation at which reserves are calculated (that is, for a group of contracts) shall be determined as follows:

a. Cash flow assumptions. Net premiums shall be updated for cash flow changes. An insurance entity shall update its estimate of cash flows expected over the entire life of a group of contracts using actual historical experience and updated future cash flow assumptions. An insurance entity shall recalculate net premiums by comparing the present value of actual historical benefits and related actual (if applicable) historical expenses plus updated remaining expected benefits and related expenses, less the liability carryover basis (if applicable), with the present value of actual historical gross premiums plus the updated remaining expected gross premiums (see Examples 6 and 7 in paragraphs 944-40- 55-29H through 55-29U). The revised ratio of net premiums to gross premiums shall not exceed 100 percent (see paragraph 944-40-35-7A).

1. Liability remeasurement gain or loss. The revised net premiums shall be used to derive an updated liability for future policy benefits as of the beginning of the current reporting period, discounted at the original (that is, contract issuance) discount rate. The updated liability for future policy benefits as of the beginning of the current reporting period shall then be compared with the carrying amount of the liability as of that date (that is, before the updating of cash flow assumptions) to determine the current period change in liability estimate (that is, the liability remeasurement gain or loss) to be recognized in net income for the current reporting period (see paragraph 944-40-45-4 for presentation requirements).

2. Current-period benefit expense. The revised net premiums shall be applied as of the beginning of the current reporting period to derive the benefit expense for the current reporting period (see paragraph 944-40-45-4 for presentation requirements).

3. Subsequent periods. In subsequent periods, the revised net premiums shall be used to measure the liability for future policy benefits, subject to future revisions.

b. Discount rate assumptions. Net premiums shall not be updated for discount rate assumption changes.

1. The difference between the updated carrying amount of the liability for future policy benefits (that is, the present value of future benefits and expenses less the present value of future net premiums based on updated cash flow assumptions) measured using the updated discount rate assumption and the original discount rate assumption shall be recognized directly to other comprehensive income (that is, on an immediate basis).

2. The interest accretion rate shall remain the original discount rate used at contract issue date.

944-40-35-7 Paragraph superseded by Accounting Standards Update No. 2018-12.Paragraph 944-40-35-1 provides guidance on determining the liability for future policy benefits using revised assumptions in the event of a premium deficiency.

944-40-35-7A If the updating of cash flow assumptions results in the present value of future benefits and expenses exceeding the present value of future gross premiums, an insurance entity shall:

a. Set net premiums equal to gross premiums.

b. Increase the liability for future policy benefits.

c. Recognize a corresponding charge to net income for the current reporting period (see paragraph 944-40-45-4) such that net premiums are set equal to gross premiums.

In subsequent periods (that is, until assumptions are subsequently updated), the liability for future policy benefits shall be accrued with net premiums set equal to gross premiums.

944-40-35-7B In no event shall the liability for future policy benefits balance be less than zero at the level of aggregation at which reserves are calculated.

> Universal Life-Type Contracts and Nontraditional Contract Benefits

a. Contracts with death or other insurance benefit features

b. Contracts with annuitization benefits.

> > Additional Liability

> > > Market Risk Benefits

944-40-35-8A A market risk benefit may be positive (that is, an asset) or negative (that is, a liability). Changes in fair value related to market risk benefits shall be recognized in net income, with the exception of fair value changes attributable to a change in the instrument-specific credit risk of market risk benefits in a liability position. The portion of a fair value change attributable to a change in the instrument-specific credit risk of market risk benefits in a liability position shall be recognized in other comprehensive income (see paragraph 944-40-45-3).

944-40-35-8B Upon derecognition of a market risk benefit, an insurance entity shall derecognize any related amount included in accumulated other comprehensive income. An insurance entity only shall include in net income any gain or loss that is realized as a result of the insurance entity’s nonperformance (that is, the settlement or extinguishment of an obligation for an amount less than the contractual obligation amount). On the date of annuitization (for annuitization benefits) or upon extinguishment of the account balance (for withdrawal benefits) the balance related to the market risk benefit shall be derecognized, and the amount deducted (after derecognition of any related amount included in accumulated other comprehensive income) shall be used in the calculation of the liability for future policy benefits for the payout annuity (including the establishment of a deferred profit liability to the extent that the market risk benefit amount deducted exceeds the amount of the liability for future policy benefits or the recognition of an immediate loss to the extent that the amount of the liability for future policy benefits exceeds the market risk benefit amount deducted).

> > >> > Contracts with

Death or Other Insurance BenefitsBenefit Features

944-40-35-9 An insurance entity shall regularly evaluate estimates used and adjust the additional liability balance, with a related charge or credit to benefit expense (see paragraph 944-40-45-1), if actual experience or other evidence suggests that earlier assumptions should be revised. In making such revised estimates, both the present value of total excess payments and the present value of total expected assessments and investment margins shall be calculated as of the balance sheet date using historical experience from the issue date to the balance sheet date and estimated experience thereafter.

944-40-35-10 The additional liability at the balance sheet date shall be equal to:

a. The current benefit ratio multiplied by the cumulative assessments (cumulative assessments shall be calculated as actual cumulative assessments, including investment margins, if applicable, recorded from contract inception through the balance sheet date)

b. Less the cumulative excess payments (including amounts reflected in claims payable liabilities)

c. Plus accreted interest.

However, in no event shall the additional liability balance be less than zero.

944-40-35-11 Paragraph superseded by Accounting Standards Update No. 2018-12.Paragraph 944-40-45-1 states that the change in the additional liability shall be recognized as a component of benefit expense in the statement of operations.

> > > > > Contracts with

Annuitization Benefits

944-40-35-12 The insurance entity shall regularly evaluate estimates used and adjust the additional liability balance recognized under paragraph 944-40-25-27 with a related charge or credit to benefit expense (see paragraph 944-40-45-2), if actual experience or other evidence suggests that earlier assumptions should be revised.

944-40-35-13 In making such revised estimates, both the present value of total excess payments and the present value of total expected assessments or investment margins shall be calculated as of the balance sheet date using historical experience from the issue date to the balance sheet date and estimated experience thereafter.

944-40-35-14 The additional liability at the balance sheet date shall be equal to the sum of the following:

a. The current benefit ratio multiplied by the cumulative assessments

b. Accreted interest (an addition)

c. At time of annuitization, the cumulative excess payments determined at annuitization (a deduction).

However, in no event shall the additional liability balance be less than zero.

944-40-35-15 The cumulative excess payments determined at annuitization in

(c) in the preceding

paragraph

944-40-35-14(c) is the amount that shall be deducted at the actual date of annuitization. That amount shall be calculated as the present value of expected annuity payments and related

claim adjustment expenses discounted at

an upper-medium grade (low-credit-risk) fixed-income instrument yield expected investment yields

minus the accrued account balance at the actual annuitization date.

944-40-35-16 On the date of annuitization

or extinguishment of the account balance, the additional liability related to the cumulative excess benefits will be

zero

derecognized and the amount deducted will be used in the calculation of the liability for the payout annuity.

> > > > >

Insurance Benefit Feature That Wraps a Noninsurance Contract

944-40-35-17 A reinsurer or issuer of the insurance benefit features of a contract shall calculate a liability for the portion of premiums collected each period that represents compensation to the insurance entity for benefits that are assessed in a manner that is expected to result in current profits and future losses from the insurance benefit function.

944-40-35-18 That liability shall be calculated using the methodology described in paragraphs

944-40-35-8A944-40-35-9

through

35-10 and 944-40-35-12 through 35-16 35-11. For example, a reinsurance contract that assumes only the risk related to the minimum guaranteed death benefit feature for a fee that varies with the account balance rather than with the insurance coverage provided is a universal life-type contract that shall be accounted for in accordance with those paragraphs.

> > Two-Tier Annuity

944-40-35-19 The accrued account balance for a two-tier annuity during the accumulation phase shall be calculated using the lower-tier rate because the account balance accumulated at the lower tier is the amount that would be available in cash at maturity if the contract holder elects not to annuitize the contract.

944-40-35-20 An additional liability

determined

recognized in accordance with paragraphs 944-40-25-26 through 25-27

or a market risk benefit, as applicable, shall be recognized during the accumulation phase for the

annuitization

benefit in excess of the accrued account balance.

944-40-35-21 If there is an additional liability for the annuitization benefit and a contract holder elects to annuitize, the present value of annuitization payments, including related incremental claims adjustment expenses, discounted

using an upper-medium grade (low-credit-risk) fixed-income instrument yield at expected investment yields

would represent the single premium used to purchase the annuitization benefit.

> Certain Participating Life Insurance Contracts—Terminal Dividends

944-40-35-22 Terminal dividends accrued under paragraph 944-40-25-30 shall be recognized as an expense over the life of a book of participating life insurance contracts, at a constant rate based on the present value of the

base used for the amortization of deferred acquisition costsestimated gross margin amounts expected to be realized over the life of the book of contracts

.

944-40-35-23 The present value of

the amortization baseestimated gross margins

shall be computed using the expected

investment yield (net of related investment expenses).

Accordingly, interest shall accrue on the balance of terminal dividends.

944-40-35-24 Paragraph superseded by Accounting Standards Update No. 2018-12.If significant negative gross margins are expected in any period, then the present value of gross margins before annual dividends, estimated gross premiums, or the balance of insurance in force shall be substituted as the base for computing the expense amount to be recognized. The base substituted in this calculation shall be the same one substituted in the amortization of deferred acquisition costs discussed in paragraph 944-30-35-11.

944-40-35-25 Increases in the liability for future policy benefits shall be reported as an expense in the statement of earnings.

13. Amend paragraphs 944-40-45-1 through 45-2 and their related headings, 944-40-50-6 through 50-7 and their related heading, 944-40-55-14 through 55-17 and their related heading, 944-40-55-20 through 55-23, and 944-40-55-25 through 55-28, add paragraphs 944-40-45-3 through 45-4 and their related headings, 944-40-50-5A, 944-40-50-7A through 50-7C and their related headings, 944-40-55-13A through 55-13K and their related headings, and 944-40-55-29A through 55-29U and their related headings, and supersede paragraphs 944-40-55-18, 944-40-5524, and 944-40-55-29, with a link to transition paragraph 944-40-65-2, as follows:

Other Presentation Matters

Long-Duration Contracts

> Universal Life-Type Contracts and Nontraditional Contract Benefits

> > Contracts with

Death or Other Insurance BenefitsBenefit Features

944-40-45-1 TheA

change in the

estimate of the additional liability

for death or other insurance benefits recognized under the guidance in paragraph 944-40-25-27A as of the beginning of the current period (that is, the liability remeasurement gain or loss as a result of applying the revised benefit ratio) shall be

presentedrecognized

as a

separate component of total benefit expense in the statement of

operations.

operations, either parenthetically or as a separate line item. The liability remeasurement gain or loss may be reported together with the liability remeasurement gain or loss related to annuitization benefits and traditional and traditional and limited-payment contracts

> > Contracts That Provide

Annuitization Benefits

944-40-45-2 The change in the

estimate of the additional liability

for annuitization benefits recognized under

paragraphs 944-40-25-22 through 25-24

the guidance in paragraph 944-40-25-27 as of the beginning of the current period (that is, the liability remeasurement gain or loss as a result of applying the revised benefit ratio) shall be

presentedreported

as a

separate component of

total benefit expense in the statement of

operations.

operations, either parenthetically or as a separate line item. The liability remeasurement gain or loss may be reported together with the liability remeasurement gain or loss related to death or other insurance benefits and traditional and limited-payment contracts.

> > Market Risk Benefits

944-40-45-3 The carrying amount of market risk benefits shall be presented separately in the statement of financial position. The change in fair value related to market risk benefits shall be presented separately in net income, except fair value changes attributable to a change in the instrument-specific credit risk of market risk benefits in a liability position. The portion of a fair value change attributable to a change in the instrument-specific credit risk of market risk benefits in a liability position shall be presented separately in other comprehensive income.

> Traditional and Limited-Payment Contracts

944-40-45-4 The current-period change in estimate of the liability for future policy benefits (that is, the liability remeasurement gain or loss) calculated under paragraph 944-40-35-6A(a)(1) shall be presented as a separate component of total benefit expense in the statement of operations, either parenthetically or as a separate line item. For limited-payment contracts, the corresponding current-period change in estimate of the deferred profit liability (that is, the liability remeasurement gain or loss) calculated under paragraph 944-605-35-1C shall be presented separately in net income, either parenthetically or as a separate line item. The liability remeasurement gain or loss for traditional and limited-payment contracts may be reported together with the liability remeasurement gain or loss related to annuitization benefits and death or other insurance benefits.

Disclosure

Long-Duration Contracts

944-40-50-5A An insurance entity shall disclose the information required by paragraphs 944-40-50-6 through 50-7C in a manner that allows users to understand the amount, timing, and uncertainty of future cash flows arising from the liabilities. An insurance entity shall aggregate or disaggregate the disclosures in paragraphs 944-40-50-6 through 50-7C so that useful information is not obscured by the inclusion of a large amount of insignificant detail or by the aggregation of items that have significantly different characteristics (see paragraphs 944-40-55-13F through 55-13H). An insurance entity need not provide disclosures about liabilities for insignificant categories; however, balances for insignificant categories shall be included in the reconciliations.

> Traditional Long-Duration Contracts

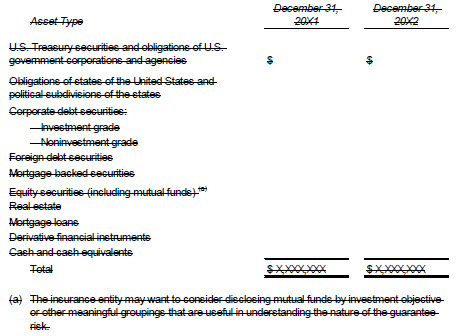

Liability for Future Policy Benefits and Additional Liability for Annuitization, Death, or Other Insurance Benefits

944-40-50-6 Insurance entities shall disclose in their financial statements the methods and assumptions used in estimating the liability for future policy benefits.

For annual and interim reporting periods, an insurance entity shall disclose the following information about the liability for future policy benefits for traditional and limited-payment contracts described in paragraph 944-40-25-11 and the additional liability for annuitization, death, or other insurance benefits described in paragraphs 944-40-25-26 through 25-27A, as applicable to each of of those liabilities:

a.A year-to-date disaggregated tabular rollforward of the beginning balance to the ending balance (see paragraph 944-40-55-13I). Amounts shall be presented gross of any related reinsurance recoverable. For the liability for future policy benefits for traditional and limited-payment contracts, the insurance entity shall present expected future net premiums separate from expected future benefits.

b. For each disaggregated rollforward presented, either as a component of the rollforward or as accompanying information:

1. For traditional and limited-payment contracts, the undiscounted and discounted ending balance of expected future gross premiums and expected future benefits and expenses

2. Actual experience during the period for mortality, morbidity, and lapses, compared with what was expected for the period

3. The amount of revenue and interest recognized in the statement of operations

4. The amount of any related reinsurance recoverable

5. The weighted-average duration of the liability

6 The weighted-average interest rate, a description of the technique(s) used to determine the interest rate assumption, and information about any adjustments to observable market information.

c. A reconciliation of the disaggregated rollforwards to the aggregate ending carrying amount of the liability for future policy benefits and the additional liability in the statement of financial position and the total revenue and interest recognized in the statement of operations.

d. For traditional and limited-payment contracts, qualitative and quantitative information about adverse development that resulted in an immediate charge to current-period net income because of net premiums exceeding gross premiums.

944-40-50-7 Insurance entities are encouraged to disclose the average rate of assumed investment yields in effect for the current year.

For annual reporting periods, and to the extent required by Topic 270 on interim reporting, an insurance entity shall disclose information about:

a. The significant inputs, judgments, assumptions, and methods used in measuring the liability for future policy benefits and the additional liability

b. Changes in those significant inputs, judgments, and assumptions during the period, and the effect of those changes on the measurement of the liability.

> Liability for Policyholders' Account Balances

944-40-50-7A For annual and interim reporting periods, an insurance entity shall disclose the following information about the liability for policyholders’ account balances described in paragraph 944-40-25-14 (excluding separate accounts described in paragraph 944-80-25-2):

a. A year-to-date disaggregated tabular rollforward of the beginning balance to the ending balance (see paragraph 944-40-55-13J).

b. For each disaggregated rollforward:

1. The weighted-average crediting rate

2. The guaranteed benefit amounts in excess of the current account balances

3. Cash surrender value.

c. A reconciliation of the disaggregated rollforwards to the aggregate ending carrying amount of the liability for policyholders’ account balances in the statement of financial position.

d. A tabular presentation of policyholders’ account balances by range of guaranteed minimum crediting rates and the related range of the difference between rates being credited to policyholders and the respective guaranteed minimums.

> Market Risk Benefits

944-40-50-7B For annual and interim reporting periods, an insurance entity shall disclose the following information about market risk benefits:

a. A year-to-date disaggregated tabular rollforward of the beginning balance to the ending balance (see paragraph 944-40-55-13K)

b. For each disaggregated rollforward, the guaranteed benefit amounts in excess of the current account balances (for example, the net amount at risk) and weighted-average attained age of contract holders

c. A reconciliation of the disaggregated rollforwards to the aggregate ending carrying amount in the statement of financial position, disaggregated between market risk benefits that are in an asset position and those that are in a liability position.

944-40-50-7C For annual reporting periods, and to the extent required by Topic 270 on interim reporting, an insurance entity shall disclose information about:

a. The significant inputs, judgments, assumptions, and methods used in measurement

b. Changes in those significant inputs, judgments, and assumptions during the period and the effect of those changes on the measurement of market risk benefits.

Implementation Guidance and Illustrations

Long-Duration Contracts

> Implementation Guidance

> > Liability for Future Policy Benefits

> > > Cash Flow Assumption Updating

944-40-55-13A Paragraphs 944-40-35-5 through 35-6A and 944-40-35-7A through 35-7B require an insurance entity to review—and if there is a change, update—cash flow assumptions used in estimating the liability for future policy benefits at the level of aggregation at which reserves are calculated. Example 6 (beginning in paragraph 944-40-55-29H) illustrates the calculation of the liability, including subsequent changes in the estimate of the liability.

944-40-55-13B If the adjustment related to updating cash flow assumptions is an unfavorable adjustment because of expected net premiums exceeding expected gross premiums (that is, expected benefits and related expenses exceed expected gross premiums), the insurance entity should:

a. Set net premiums equal to gross premiums

b. Increase the estimate of the liability for future policy benefits as of the beginning of the current reporting period

c. Recognize a corresponding adjustment to net income for the current reporting period (see paragraph 944-40-45-4)

d. Disclose qualitative and quantitative information related to adverse development (see paragraph 944-40-50-6(d))

e. Accrue the liability for future policy benefits with net premiums being set equal to gross premiums (that is, a ratio of net premiums to gross premiums equal to 100 percent) until assumptions are subsequently updated.

944-40-55-13C If the adjustment related to updating cash flow assumptions is an unfavorable adjustment but does not result in net premiums exceeding gross premiums, then the insurance entity should:

a. Increase the estimate of the liability for future policy benefits as of the beginning of the current reporting period

b. Recognize a corresponding change in estimate adjustment to net income for the current reporting period (see paragraph 944-40-45-4)

c. Accrue the liability for future policy benefits with the revised ratio of net premiums to gross premiums until assumptions are subsequently updated.

944-40-55-13D If the adjustment related to updating cash flow assumptions is a favorable adjustment—including the reversal of previously recognized unfavorable adjustment described in paragraph 944-40-55-13B or 944-40-55-13C—the insurance entity should:

a. Decrease the estimate of the liability for future policy benefits as of the beginning of the current reporting period

b. Recognize a corresponding change in estimate adjustment to net income for the current reporting period (see paragraph 944-40-45-4)

c. Accrue the liability for future policy benefits with the revised ratio of net premiums to gross premiums until assumptions are subsequently updated.Recognize a corresponding adjustment to net income for the current reporting period (see paragraph 944-40-45-4)Set net premiums equal to gross premiums

> > > Discount Rate

944-40-55-13E An insurance entity should maximize the use of current observable market prices of upper-medium-grade (low-credit-risk) fixed-income instruments with durations similar to the liability for future policy benefits.

a. An insurance entity should not substitute its own estimates for observable market data unless the market data reflect transactions that are not orderly (see paragraphs 820-10-35-54I through 35-54J for additional guidance on determining whether transactions are not orderly).

b. In determining points on the yield curve for which there are limited or no observable market data for upper-medium-grade (low-credit-risk) fixed-income instruments, an insurance entity should use an estimate that is consistent with existing guidance on fair value measurement in Topic 820, particularly for Level 3 fair value measurement.

> > Disclosures

944-40-55-13F To allow financial statement users to understand the amount, timing, and uncertainty of cash flows arising from contracts issued by insurance entities, paragraph 944-40-50-5A requires that an insurance entity aggregate or disaggregate certain disclosures so that useful information is not obscured by the inclusion of a large amount of insignificant detail or by the aggregation of items that have significantly different characteristics. Consequently, the extent to which an insurance entity’s information is aggregated or disaggregated for the purpose of those disclosures depends on the facts and circumstances that pertain to the characteristics of the liability for future policy benefits, the additional liability, the liability for policyholders’ account balances, separate account liabilities, market risk benefits, or deferred acquisition costs (and balances amortized on a basis consistent with deferred acquisition costs).

944-40-55-13G In addition, when selecting the type of category to use to aggregate or disaggregate disclosures, an insurance entity should consider how information about the disclosed items has been presented for other purposes, including the following:

a. Disclosures presented outside the financial statements (for example, in statutory filings)

b. Information regularly viewed by the chief operating decision maker for evaluating financial performance

c. Other information that is similar to the types of information identified in (a) and (b) and that is used by the insurance entity or users of the insurance entity’s financial statements to evaluate the insurance entity’s financial performance or make resource allocation decisions.

944-40-55-13H Examples of categories that might be appropriate to consider to aggregate or disaggregate disclosures include the following:

a. Type of coverage (for example, major product line)

b. Geography (for example, country or region)

c. Market or type of customer (for example, individual or group lines of business).

When applying the guidance in paragraphs 944-30-50-2A through 50-2B, 944-40-50-6 through 50-7C, and 944-80-50-1 through 50-2, an insurance entity should not aggregate amounts from different reportable segments according to Topic 280, if applicable

944-40-55-13I The tabular rollforward of the beginning to the ending balance related to the liability for future policy benefits or the additional liability as required in paragraph 944-40-50-6 could include the following line items:

a. Issuances

b. Interest accrual

c. Net premiums or assessments collected

d. Benefit payments

e. Derecognition (lapses or withdrawals)

f. Effect of actual variances from expected experience

g. Effect of changes in cash flow assumptions

h. Effect of changes in discount rate assumptions.

944-40-55-13J The tabular rollforward of the beginning to the ending balance related to the liability for policyholders’ account balances as required in paragraph 944-40-50-7A could include the following line items:

a. Issuances

b. Premiums received

c. Policy charges

d. Surrenders and withdrawals

e. Benefit payments

f. Transfers from or to separate accounts

g. Interest credited.

944-40-55-13K The tabular rollforward of the beginning to the ending balance related to market risk benefits as required in paragraph 944-40-50-7B could include the following line items:

a. Issuances

b. Interest accrual

c. Attributed fees collected

d. Benefit payments

e. Effect of changes in interest rates

f. Effect of changes in equity markets

g. Effect of changes in equity index volatility

h. Actual policyholder behavior different from expected behavior

i. Effect of changes in future expected policyholder behavior

j. Effect of changes in other future expected assumptions

k. Effect of changes in the instrument-specific credit risk.

To the extent that the tabular rollforward of the beginning to the ending balance related to market risk benefits achieves the fair value disclosure requirements described in Section 820-10-50, an insurance entity need not duplicate the related fair value disclosure.

> Illustrations

> > Example 1: Calculation of an Additional Liability Related to Universal Life-Type Contracts with Death or Other Insurance Benefits Minimum Guaranteed Death Benefit Liability

944-40-55-14 This Example illustrates how to calculate an additional liability for

a portfolio of variable annuity

universal life-type contracts

with a minimum guaranteed death benefit

as discussed in

paragraphs 944-40-35-9 through 35-10

paragraph 944-40-25-27A (for example, a variable universal life insurance contract no-lapse guarantee that would meet the condition in paragraph 944-40-25-25D(b) and not be accounted for as a market risk benefit). This Example assumes that the guidance in paragraphs 944-20-15-20 through 15-25 has been followed, with the conclusion that the

mortality and

morbidity risk associated with insurance benefit features is other than nominal.

944-40-55-15 This Example assumes

all of

the following for the contracts discussed:

a. The

variable annuity

contracts have no front-end loads.

b. The mortality assessments include any explicit assessments for enhanced death benefit feature.

c. The surrender charges are calculated based on a percentage of premiums.

d. The expense assessments are a fixed annual charge.

e. The discount rate

isof

8 percent is the same rate as used for deferred acquisition cost amortization.

f. The contracts do not include market risk benefits.

944-40-55-16 Paragraphs 944-40-55-25 through

55-2855-29

contain the same basic assumptions as paragraph 944-40-55-20, but with the effect on the

components of the additional liabilityunadjusted gross profits

of a 10 percent increase in account balances (not shown in schedules) in Year 2.

944-40-55-17 This Example illustrates computations involved in

all of

the following:

b. Benefit ratio

c. Additional

minimum guaranteed death benefit

liability

944-40-55-18 Paragraph superseded by Accounting Standards Update No. 2018-12.The estimated gross profits used for the amortization of deferred acquisition costs should be adjusted to reflect the incidence of assessments and loss expense as a result of the recognition of the liability (see paragraph 944-30-35-9).

944-40-55-19 Columns in the computations that follow do not cross-foot due to rounding.

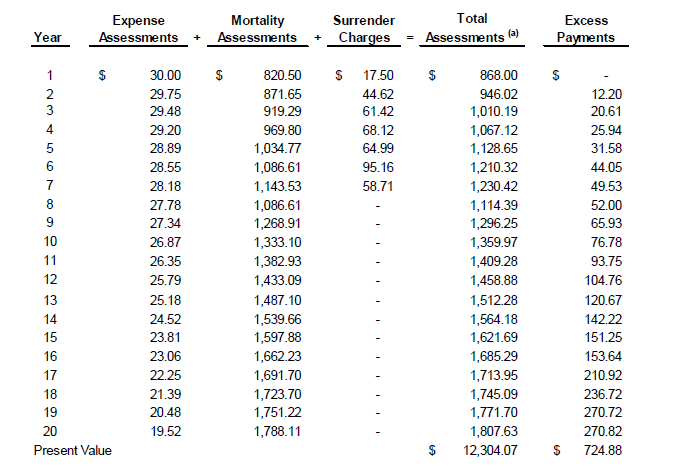

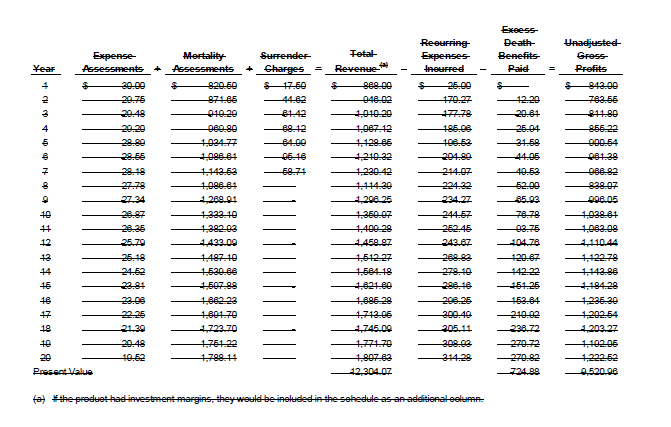

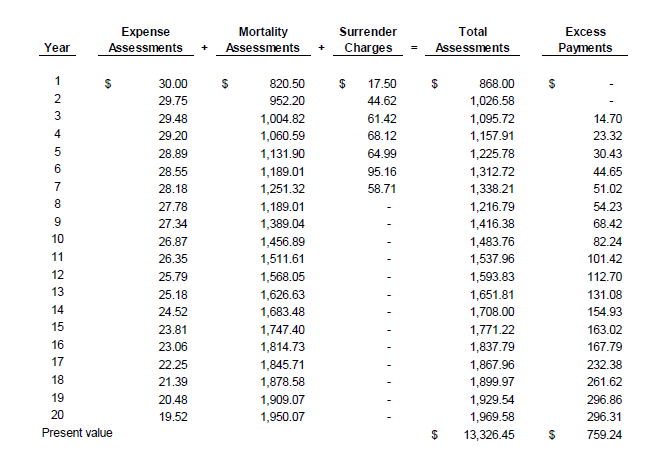

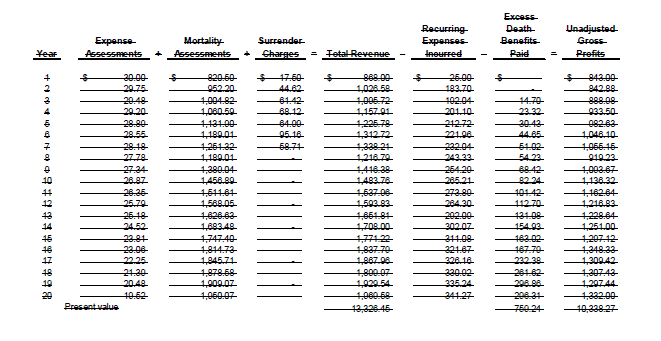

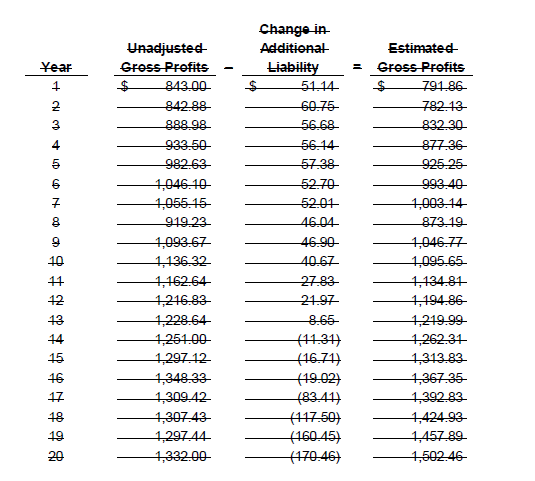

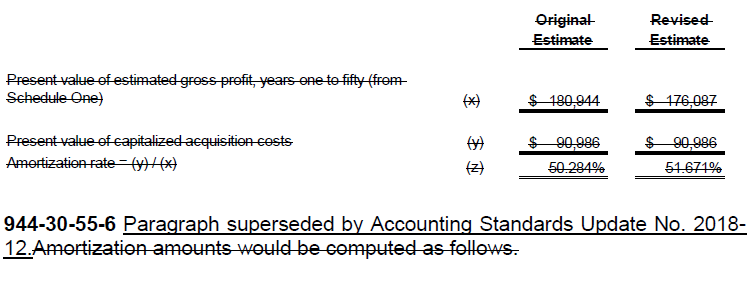

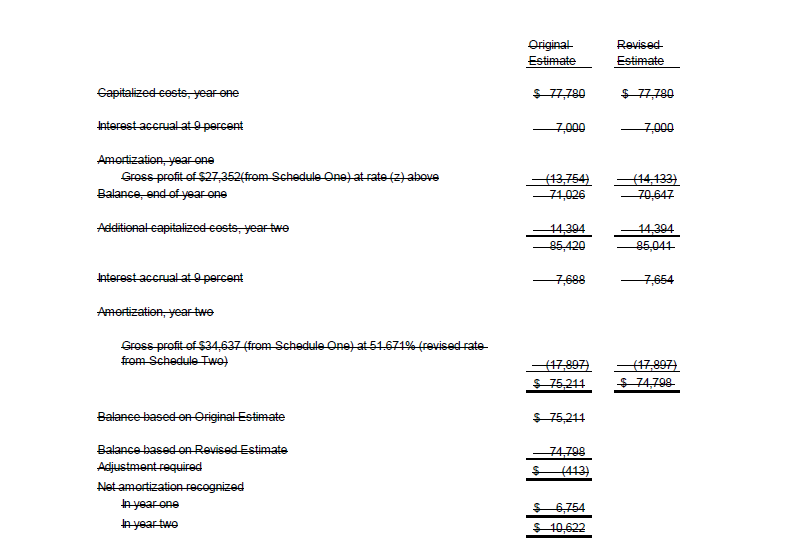

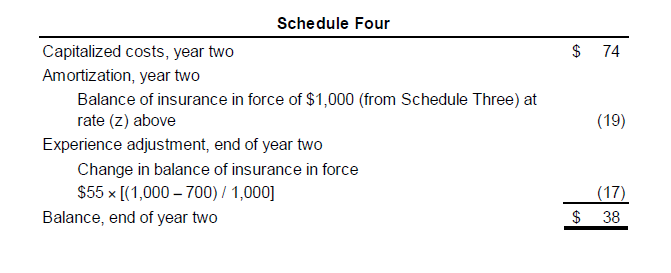

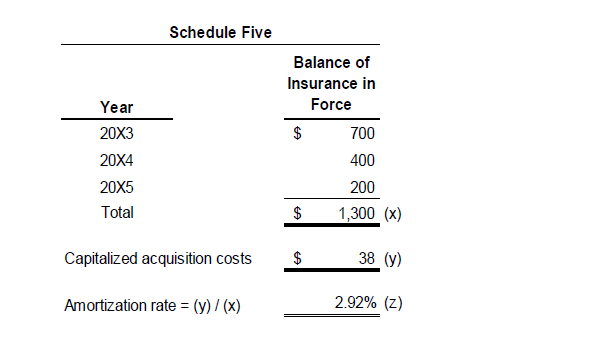

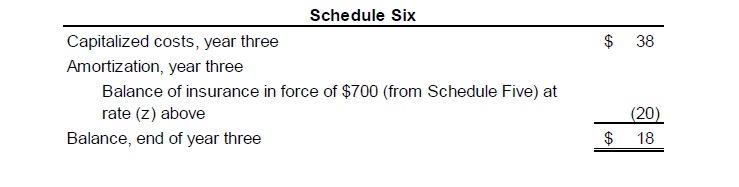

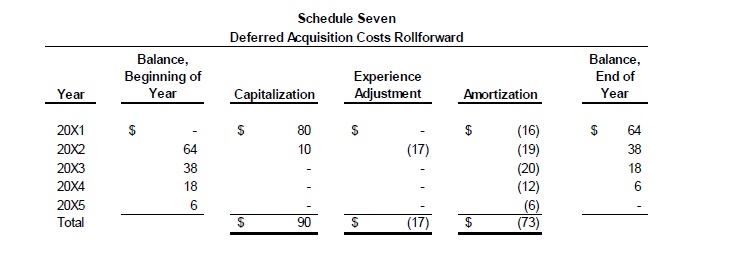

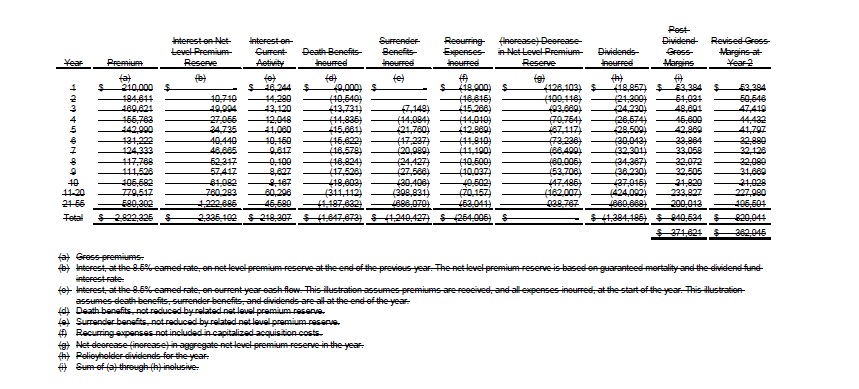

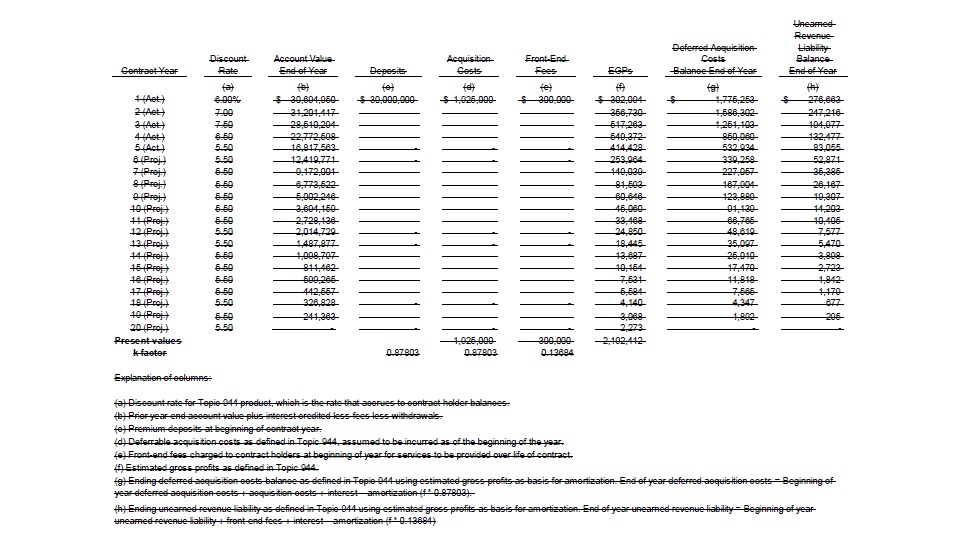

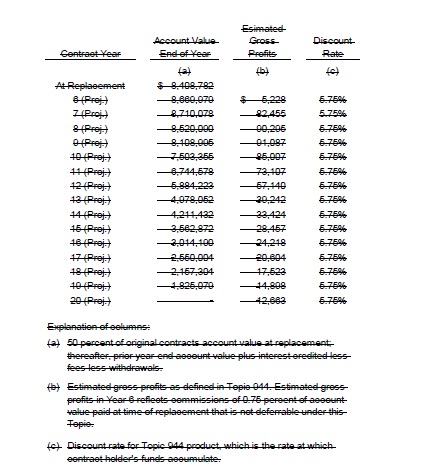

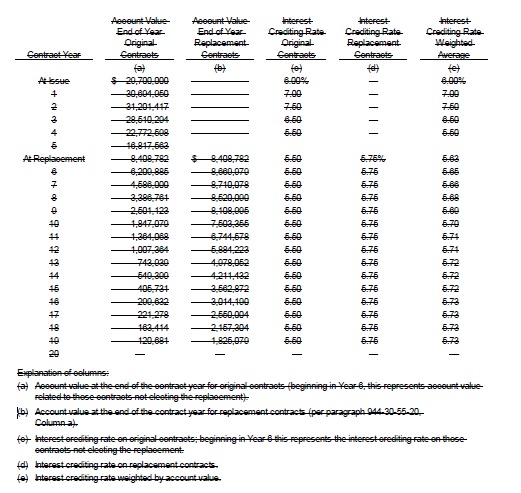

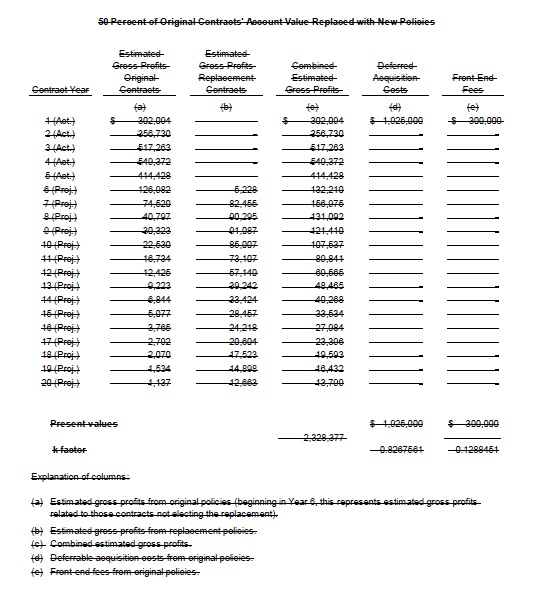

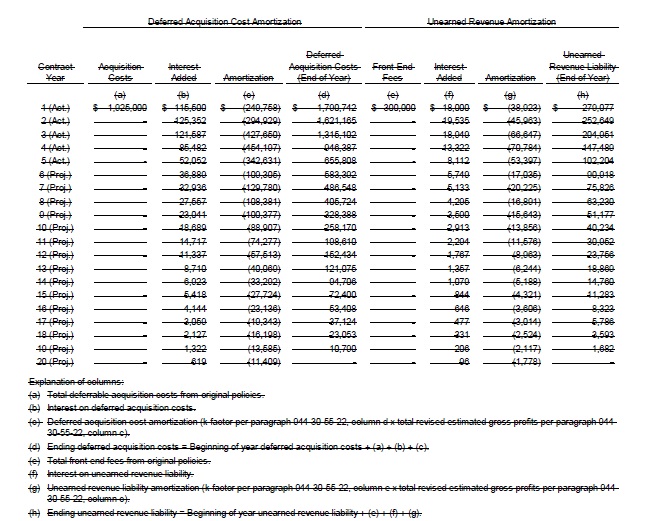

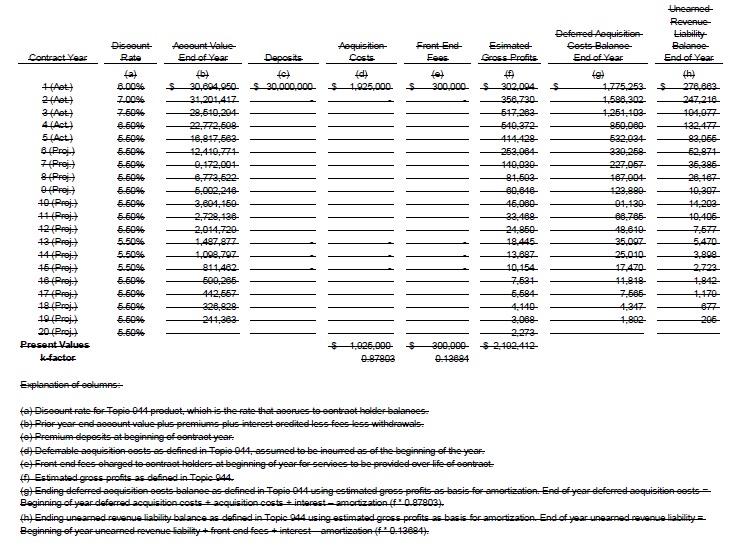

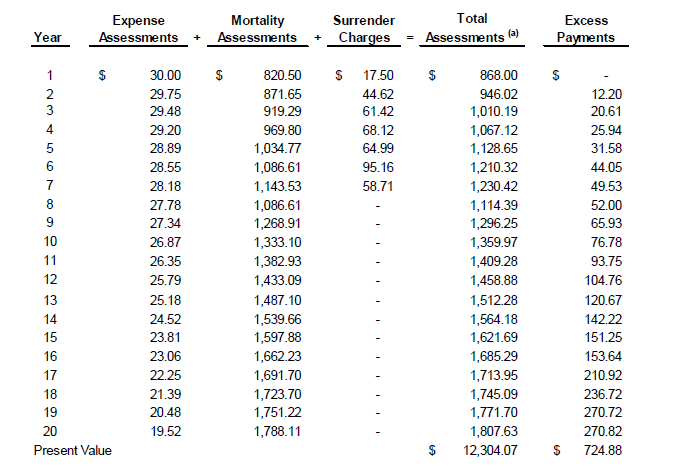

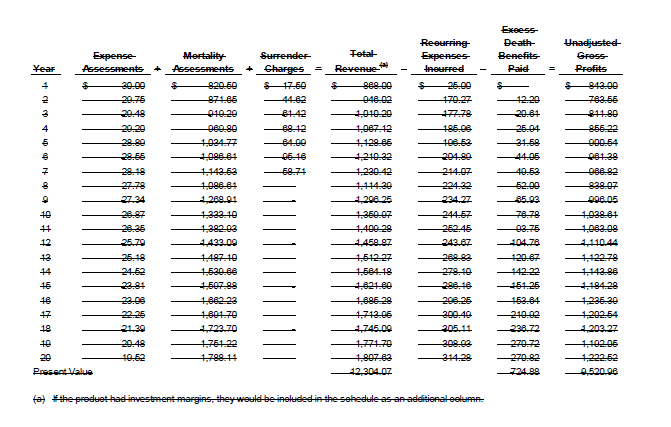

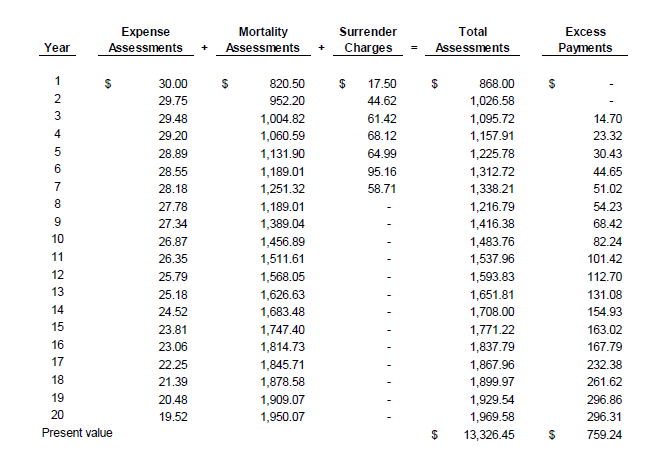

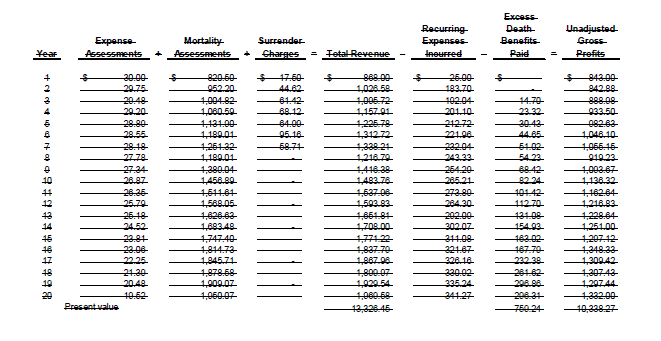

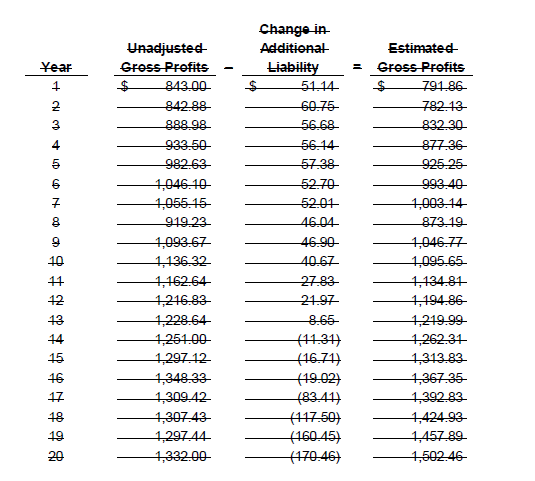

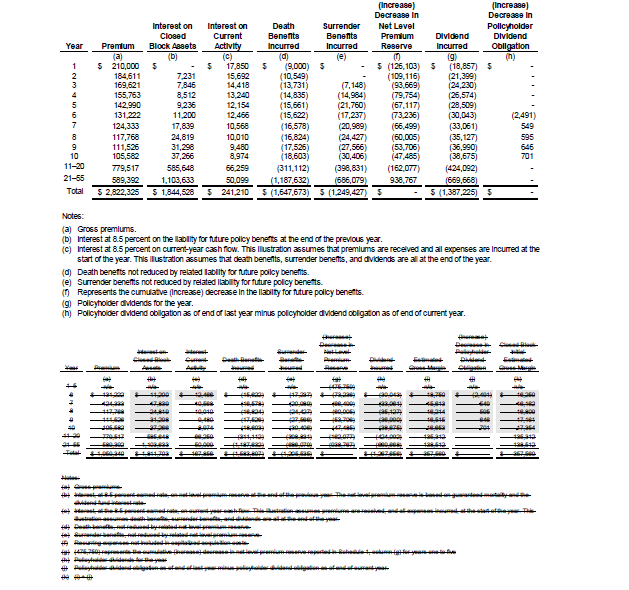

944-40-55-20 Computation of components of the additional liabilityThe computation of unadjusted gross profits

follows.

[For ease of readability, the new illustration is not underlined.]

View image

View image

(a) If the product had investment margins, they would be included in the schedule in an additional column.

View image

View image

(a) If the product had investment margins, they would be included in the schedule as an additional column.

944-40-55-21 Computation of the benefit ratio follows.

[For ease of readability, the new illustration is not underlined.]

Present value of total expected excess payments over the life of the contract |

$ 724.88 |

Divided by present value of the total expected assessments over the life of the contract |

5.8914% |

Equals benefit ratio |

5.8914% |

|

Present value of total expected excess payments over the life of the contract |

|

Divided by present value of the total expected assessments over the life of the contract |

|

|

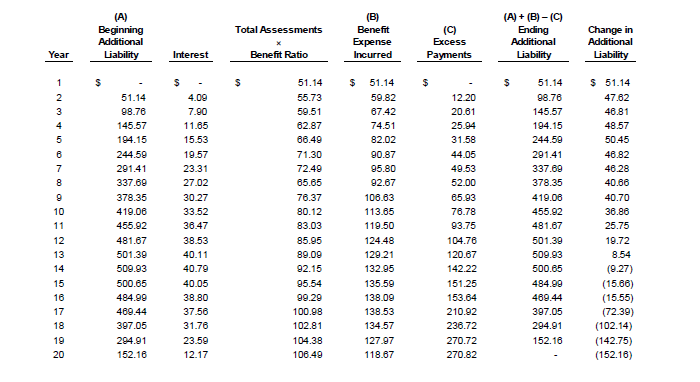

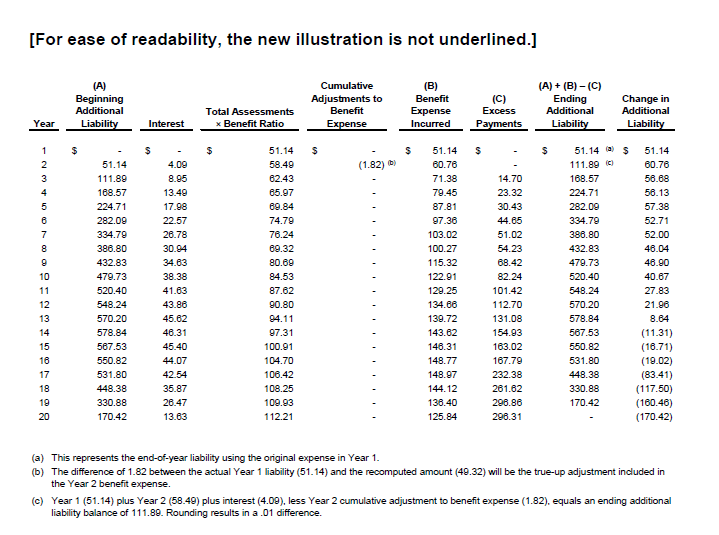

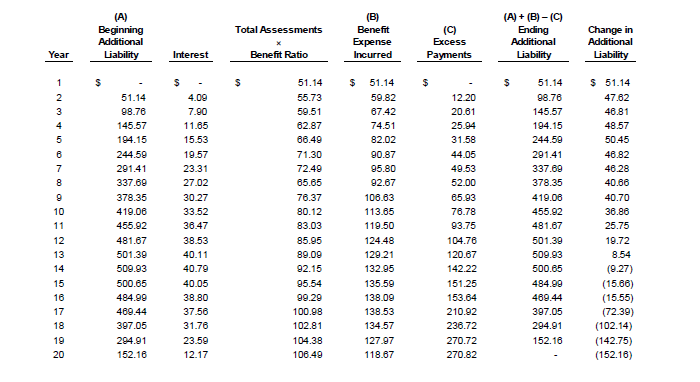

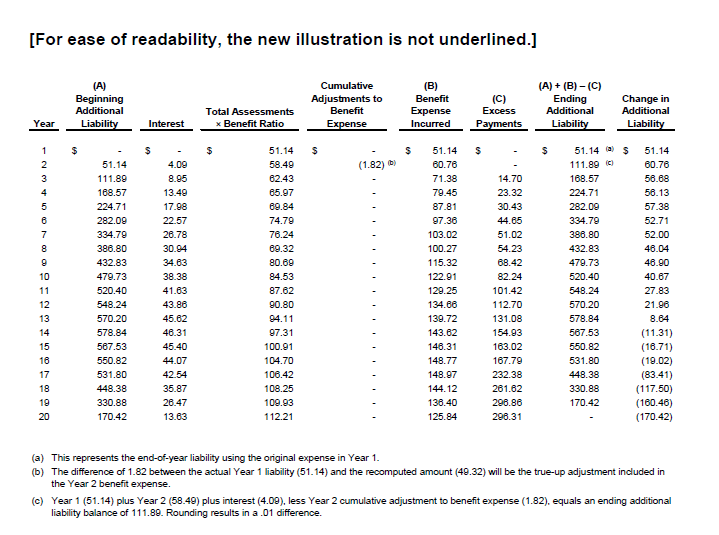

944-40-55-22 Computation of the Year 1 additional

liabilityminimum guaranteed death benefit

follows.

[For ease of readability, the new illustration is not underlined.]

Cumulative assessments |

$ 868.00 |

Multiplied by benefit ratio |

5.8914% |

Equals Year 1 additional liability |

($) 51.14 |

|

Cumulative revenue recognized |

|

Multiplied by benefit ratio |

|

Equals year 1 additional liability |

|

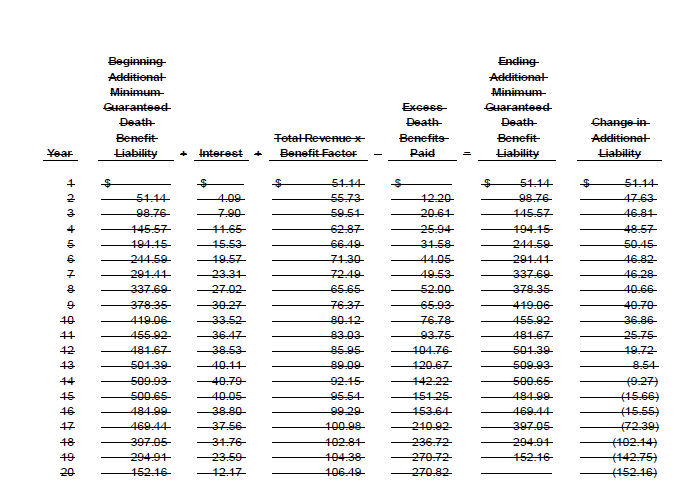

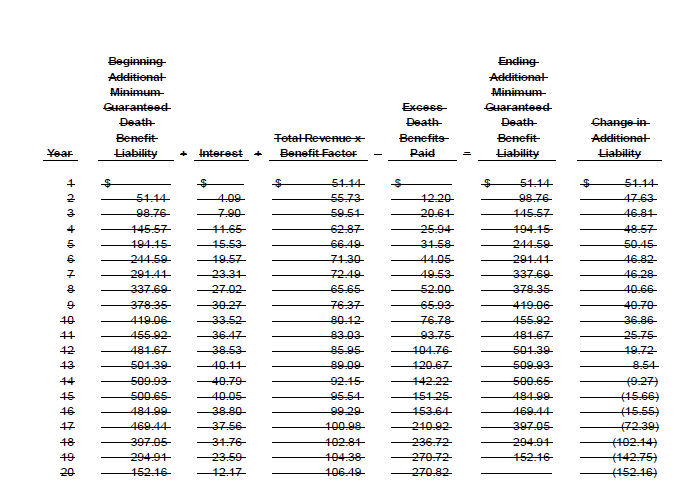

944-40-55-23 The additional

liability scheduleminimum guaranteed death benefit liability amortized over total revenue

follows.

[For ease of readability, the new illustration is not underlined.]

View image

View image

View image

View image

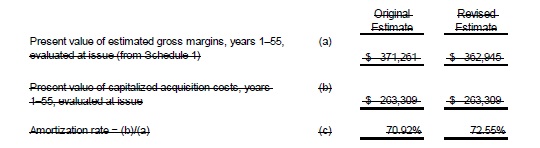

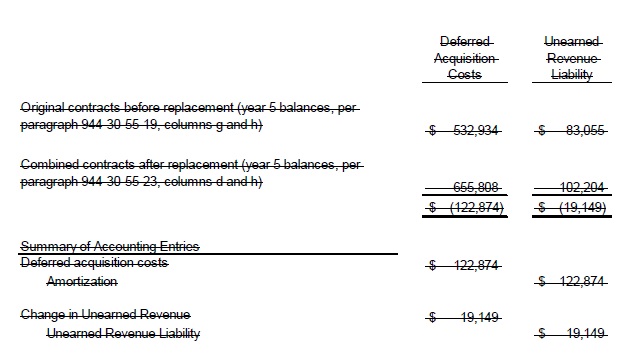

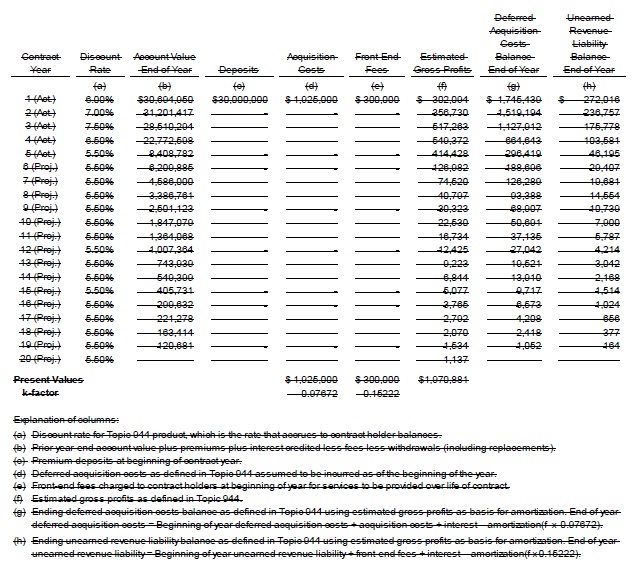

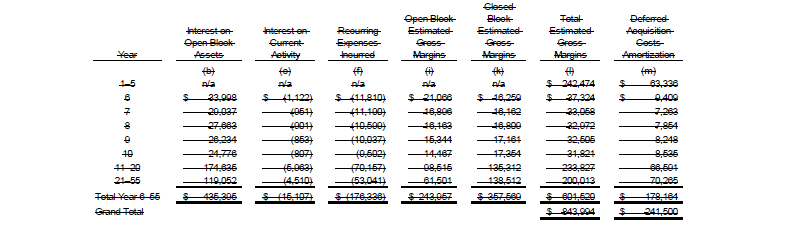

944-40-55-25 Computation of

components of the additional liabilityunadjusted gross profits

with a 10 percent increase in the account balance in Year 2 follows.

[For ease of readability, the new illustration is not underlined.]

View image

View image

View image

View image

944-40-55-26 Computation of the benefit ratio at Year 2 follows.

[For ease of readability, the new illustration is not underlined.]

Present value of total expected excess payments over the life of the contract |

$ 759.24 |

Divided by present value of total expected assessments over the life of the contract |

13,326.45 |

Equals benefit ratio |

5.6972% |

|

Present value of excess death benefits paid |

|

Divided by present value of total revenue = |

|

|

944-40-55-27 Computation of the Year 2 additional

minimum guaranteed death benefit

liability follows.

[For ease of readability, the new illustration is not underlined.]

|

Divided by present value of total expected assessments over the life of the contract |

Year 1 |

$ 8 68.00 |

Equals benefit ratio |

Year 2 |

1 ,026.58 |

|

Multiplied by benefit ratio |

|

5.6972% |

Equals Year 2 additional liability(a) |

|

($) 107.94 |

(a) Excludes interest, any deduction for actual claim expenses, and accrued interest related to cumulative adjustment to benefits expense (which amounts to $.13). |

|

Cumulative revenue recognized |

|

|

|

|

|

Multiplied by benefit ratio |

|

|

Equals Year 2 additional liability(a) |

|

|

(a) Excludes interest and any deduction for actual claim expenses. |

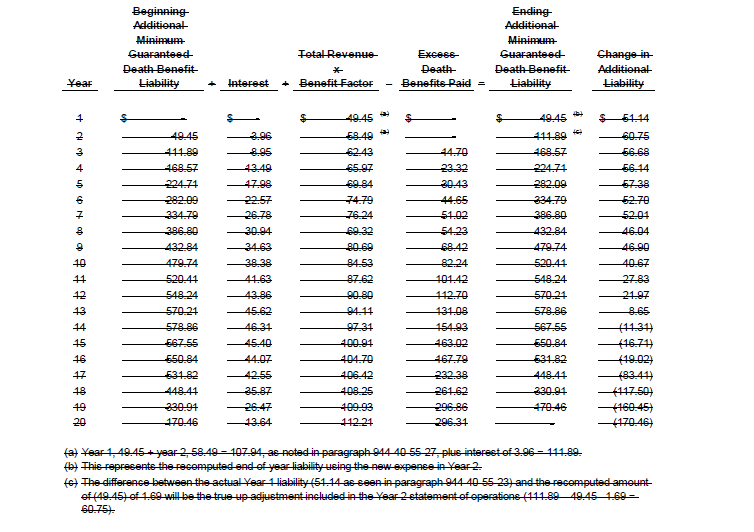

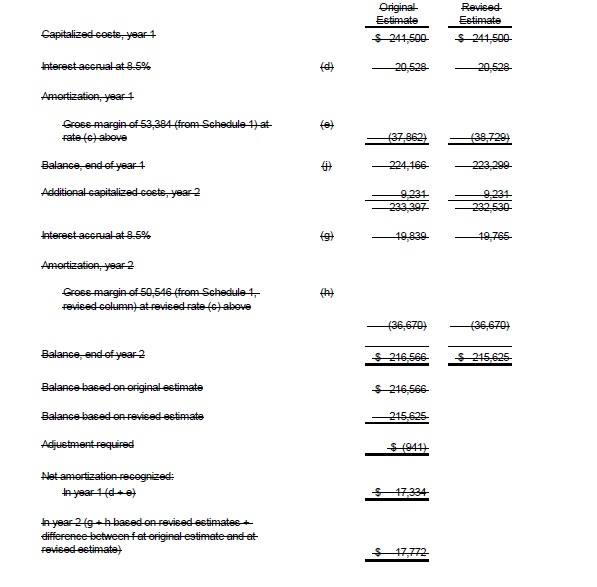

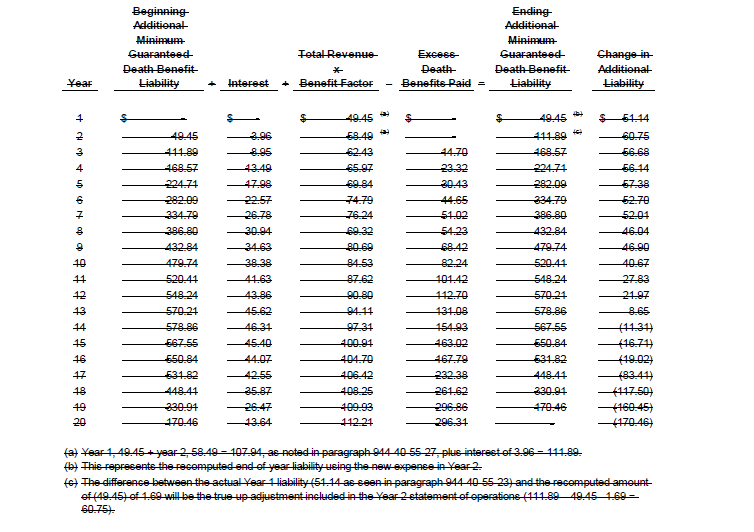

944-40-55-28 The

updated additional

minimum guaranteed death benefit

liability

amortized over total revenue

schedule follows.

[For ease of readability, the new illustration is not underlined.]

View image

View image

View image

View image

View image

View image

> > Example 2: Market Risk Benefits

> > > Guaranteed Minimum Accumulation or Death Benefit

944-40-55-29A A contract holder deposits $100,000 in a deferred variable annuity

(either fixed or variable) that provides for a

{add glossary link}guaranteed minimum accumulation benefit

{add glossary link} that guarantees that at a specified anniversary date (for example, 5 years)

. The

the contract holder's account balance will be the greater of the following:

a. The account value

, as determined by the separate account assets

b. Deposits less partial withdrawals accumulated at 3 percent interest compounded annually. [Content amended as shown and moved from paragraph 944-20-55-17]

944-40-55-29B The contract holder's account balance is exposed to stock market performance. At the specified anniversary date the contract holder's account balance has declined to $80,000 due to stock market declines. The guaranteed minimum value of the $100,000 deposit compounded annually at 3 percent interest is $115,930. The contract holder's account balance will be increased to the greater amount, resulting in an account balance of $115,930. In this Example, the guaranteed minimum accumulation benefit meets the criteria for a market risk benefit in accordance with paragraph 944-40-25-25C because the guaranteed minimum accumulation benefit protects the contract holder from other-than nominal capital market risk and exposes the insurance entity to other-than-nominal capital market risk. Specifically, the insurance entity compensates the contract holder for the shortfall (due to stock market declines) between the account balance amount of $80,000 and the guaranteed amount of $115,930. The guaranteed minimum accumulation benefit should be measured at fair value in accordance with paragraph 944-40-30-19C. Similarly, if on the date of the death of the contract holder the deferred annuity provides a guaranteed minimum death benefit amount of $115,930 while the account balance is $80,000, the guaranteed minimum death benefit meets the criteria for a market risk benefit in accordance with paragraph 944-40-25-25C because the insurance entity provides compensation for the shortfall (due to stock market declines) between the account balance amount of $80,000 and the guaranteed amount of $115,930. [Content amended as shown and moved from paragraph 944-20-55-18]

> > > Guaranteed Minimum Living Benefits

944-40-55-29C A contract holder deposits $100,000 in a deferred variable annuity

(either fixed or variable) that provides a

{add glossary link}guaranteed minimum income benefit

{add glossary link}.

The guaranteed minimum income benefit

contract specifies that if the contract holder elects to annuitize, the amount available to annuitize will be the higher of the then account balance or the sum of deposits less withdrawals. The

contract holder's account balance is exposed to stock market performance contract holder directs the deposit to equity-based funds within the separate account.

At the date that the contract holder chooses to annuitize, the account balance has declined to $80,000 due to stock market declines.

The contract holder elects a 20-year period-certain fixed payout annuity, payable monthly in arrears. Using the $100,000 guaranteed minimum account value at the date of annuitization and a guaranteed 3 percent crediting rate, the fixed monthly periodic annuity payment is $554.

[Content amended as shown and moved from paragraph 944-20-55-21]

944-40-55-29D In this Example, the guaranteed minimum income benefit meets the criteria for a market risk benefit in accordance with paragraph 944-40-25-25C because the guaranteed minimum income benefit protects the contract holder from other-than-nominal capital market risk and exposes the insurance entity to other than- nominal capital market risk. Specifically, the insurance entity compensates the contract holder for the shortfall (due to stock market declines) between the account balance amount of $80,000 and the $100,000 guaranteed amount at the annuitization date. During the accumulation phase, the guaranteed minimum income benefit feature should be measured at fair value in accordance with paragraph 944-40-30-19C. Similarly, if the deferred annuity provides a guaranteed minimum withdrawal benefit or a guaranteed minimum lifetime withdrawal benefit that protects the contract holder from other-than-nominal capital market risk and exposes the insurance entity to other-than-nominal capital market risk, the guaranteed minimum withdrawal benefit or the guaranteed minimum lifetime withdrawal benefit meets the criteria for a market risk benefit.

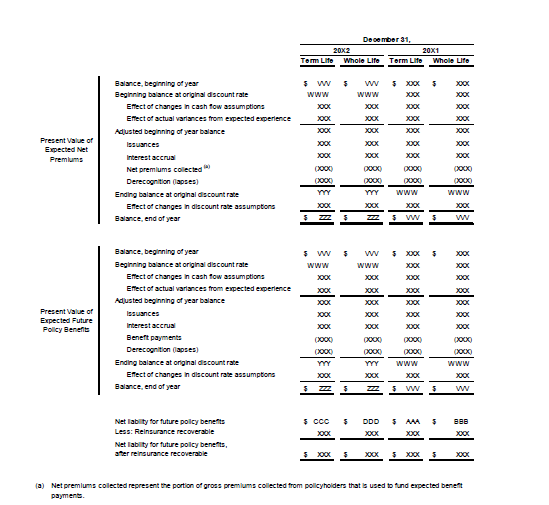

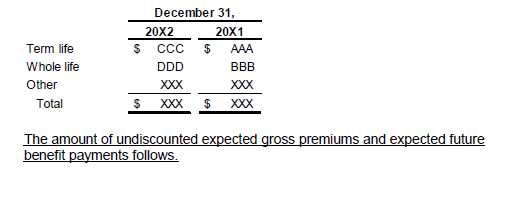

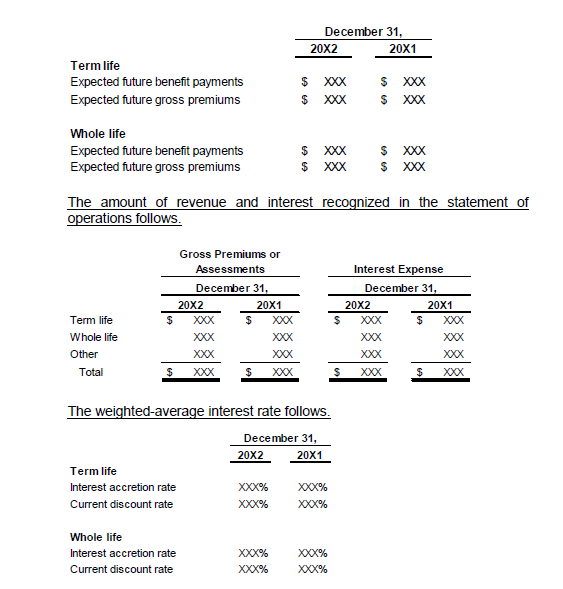

> > Example 3: Disclosure of Information about the Liability for Future Policy Benefits

944-40-55-29E This Example illustrates the information that an insurance entity with two major long-duration product lines (term life and whole life) should disclose in its 20X2 financial statements to meet certain requirements of paragraph 944-40- 50-6.

Note X: Liability for Future Policy Benefits

The balances of and changes in the liability for future policy benefits follow.

[For ease of readability, the new illustrations in Examples 3–7 are not underlined.]

The reconciliation of the net liability for future policy benefits to the liability for future policy benefits in the consolidated statement of financial position follows.

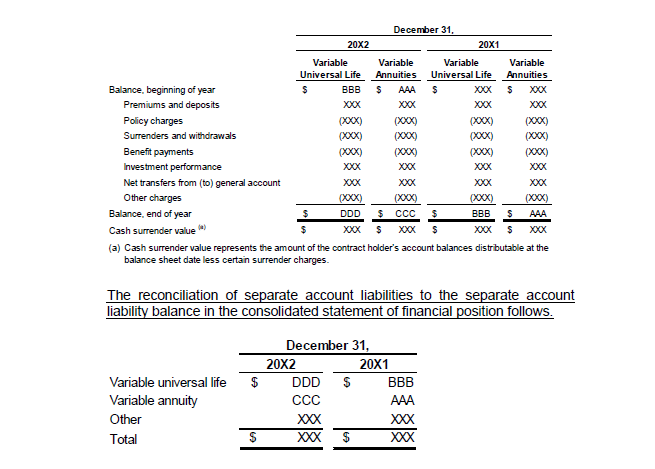

> > Example 4: Disclosure of Information about the Liability for Policyholders' Account Balances

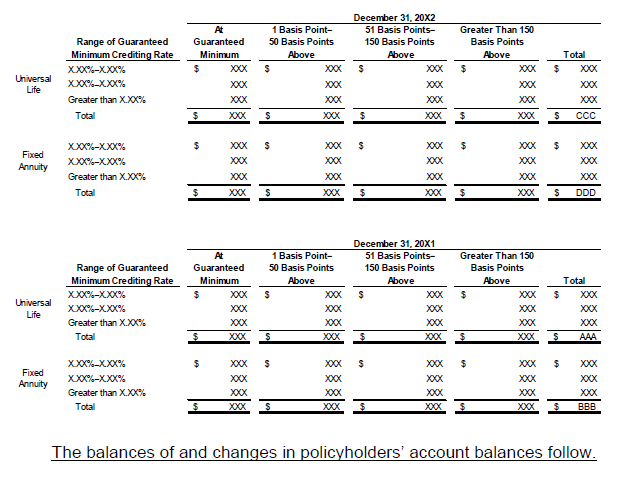

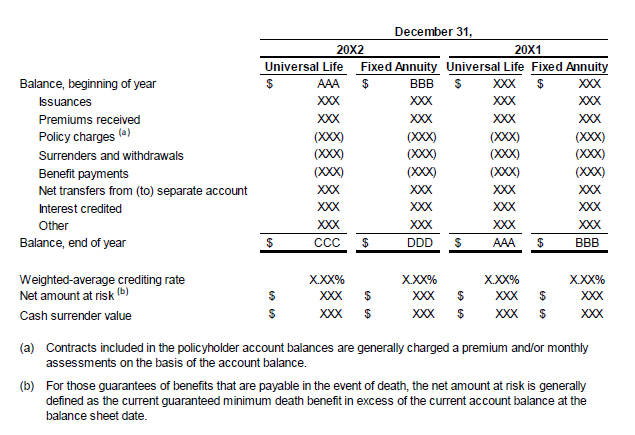

944-40-55-29F This Example illustrates the information that an insurance entity with two major long-duration products with policyholders’ account balances (universal life and fixed annuities) should disclose in its 20X2 financial statements to meet certain requirements of paragraph 944-40-50-7A.

Note X: Policyholders' Account

The balance of account values by range of guaranteed minimum crediting rates and the related range of difference, in basis points, between rates being credited to policyholders and the respective guaranteed minimums follow.

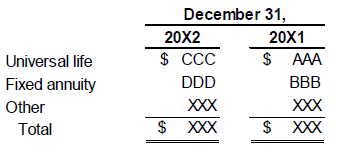

The reconciliation of policyholders’ account balances to the policyholders’ account balances’ liability in the consolidated statement of financial position follows..

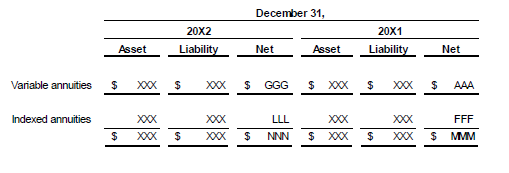

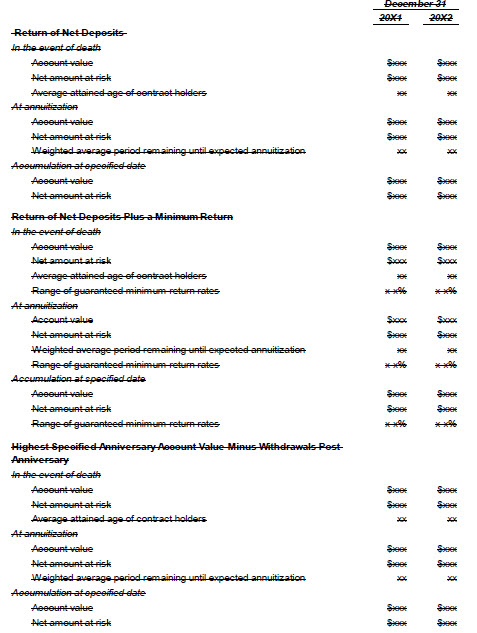

> > Example 5: Disclosure of Information about Market Risk Benefits

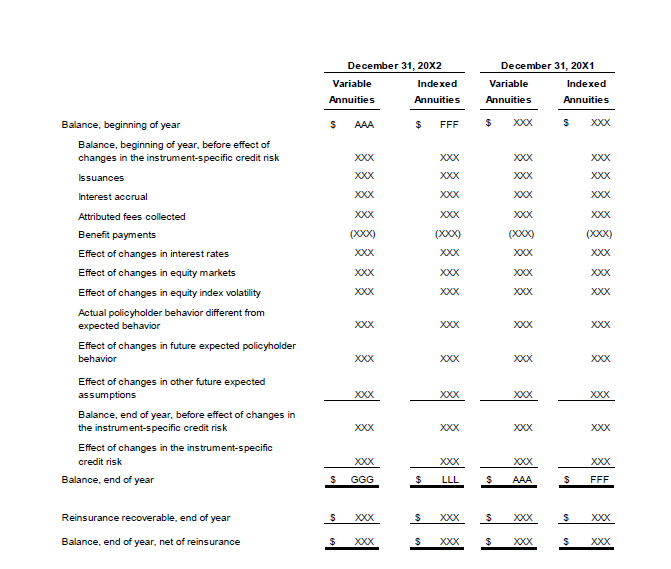

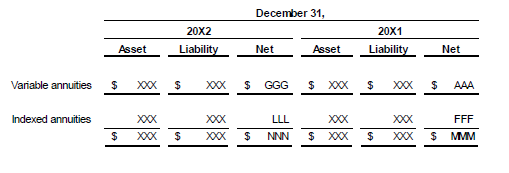

944-40-55-29G This Example illustrates the information that an insurance entity with market risk benefits should disclose in its 20X2 financial statements to meet certain requirements of paragraph 944-40-50-7B.

Note X: Market Risk Benefits

The balances of and changes in guaranteed minimum withdrawal benefits associated with variable annuities and indexed annuities follow.

The reconciliation of market risk benefits by amounts in an asset position and in a liability position to the market risk benefits amount in the consolidated statement of financial position follows.

View image

View image

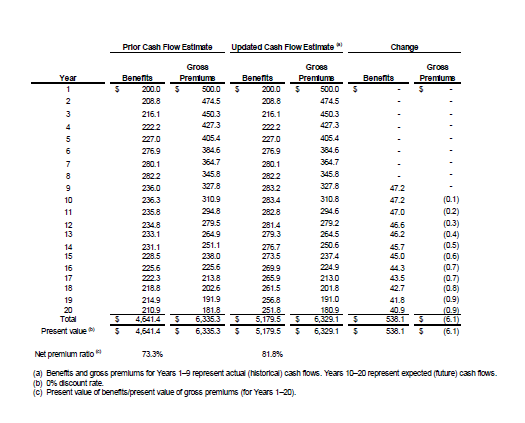

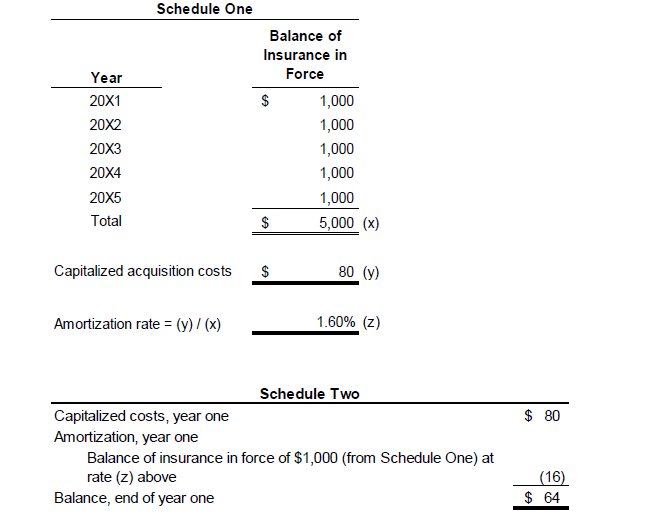

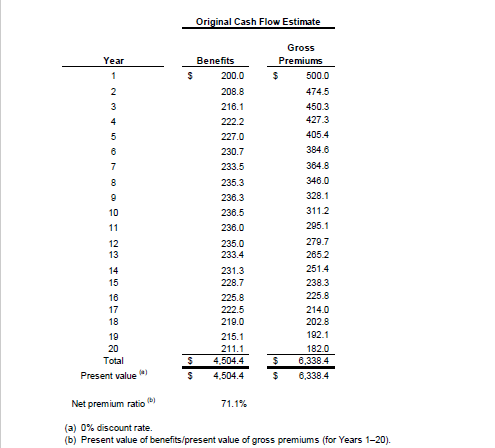

> > Example 6: Updating of Assumptions Used in the Measurement of the Liability for Future Policy Benefits

944-40-55-29H This Example illustrates an approach to updating assumptions used to measure the liability for future policy benefits related to traditional life insurance contracts.

944-40-55-29I This Example assumes the following for the contracts discussed:

a. At contract inception:

1. The insurance entity issues 1,000 guaranteed-renewable 20-year term life insurance contracts that are grouped into a single cohort for purposes of measuring the liability for future policy benefits.

2. Face amount per contract: $200,000.

3. Annual premium per contact: $500.

4 Discount rate: 0 percent.

5. Lapse rate: 5 percent for all years.

6. Mortality rate: 0.1 percent in Year 1, increasing linearly to 0.29 percent in Year 20.

7. For ease of illustration, no expenses are assumed, benefit payments and premium receipts occur at the end of the year, and annual periods are presented.

b. During Year 6: The insurance entity experiences unfavorable mortality that is 20 percent higher than expected. The insurance entity determines that it does not need to change its future mortality or lapse assumptions.

c. During Year 9: After experiencing continued unfavorable mortality (20 percent higher than expected in Years 7 through 9), the insurance entity increases its mortality assumption by 20 percent for Years 10 through 20.

d During Year 10: The current upper-medium grade (low-credit-risk) fixed-income instrument yield increases from 0 percent to 2 percent. The insurance entity does not change its future mortality or lapse assumptions.

944-40-55-29J This Example illustrates computations involved in the following:

a. Net premiums

b. Liability remeasurement adjustments.

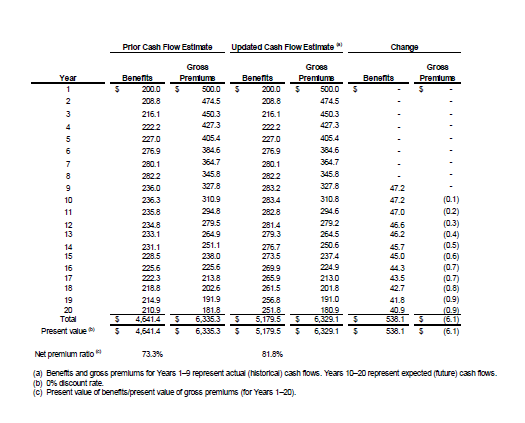

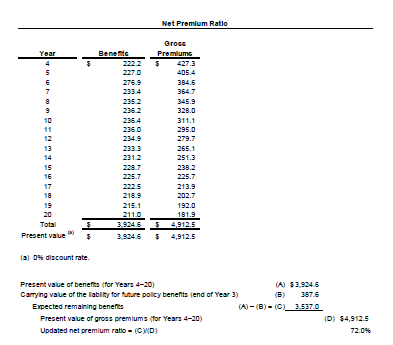

944-40-55-29K The computation of the original net premium ratio at the issue date of the portfolio of contracts follows.

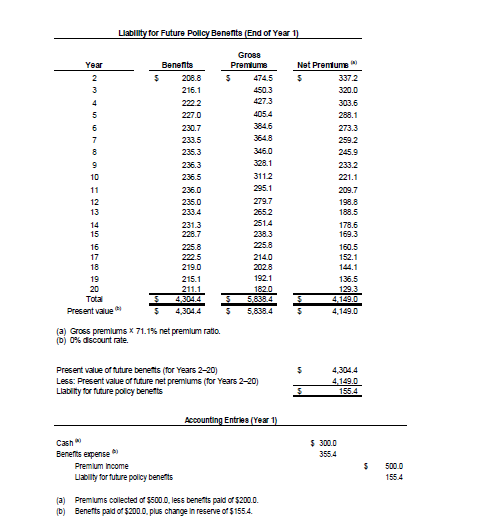

944-40-55-29L The computation of the liability for future policy benefits at the end of Year 1 follows.

944-40-55-29M At the end of Year 6, the Entity updates its mortality assumption to reflect the unfavorable experience in that year (that is, the true-up from expected experience to actual experience) and its effect on estimated cash flows. However, as specified in paragraph 944-40-35-5(a), the Entity reviewed its future cash flow assumptions and determined that its future mortality and lapse assumptions did not need to be adjusted.

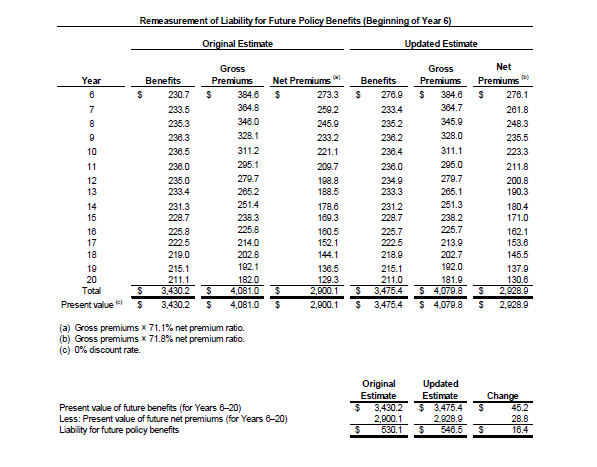

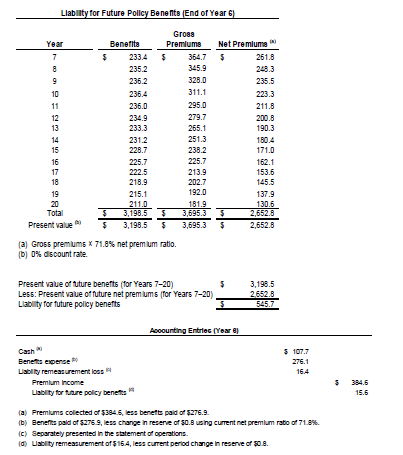

The following table provides information about the estimated cash flow effects of updating cash flow assumptions and the corresponding adjustment to the liability for future policy benefits and current-period benefit expense.

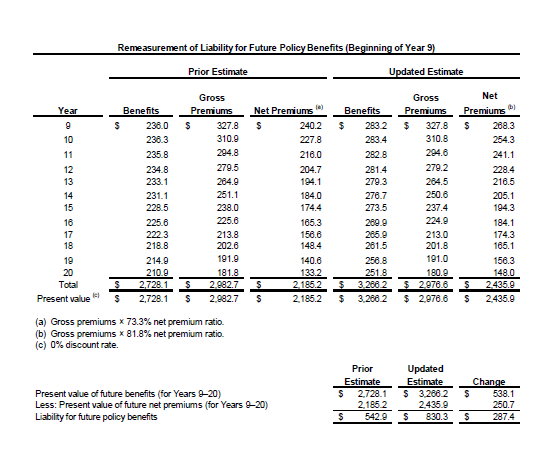

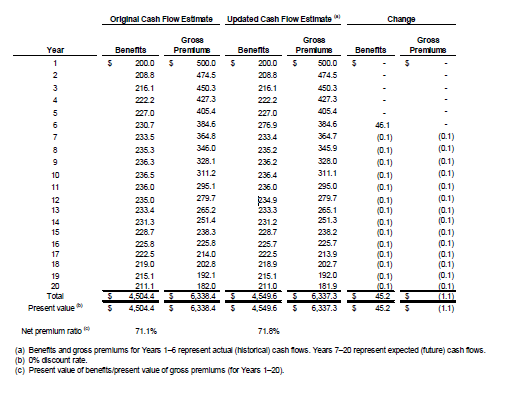

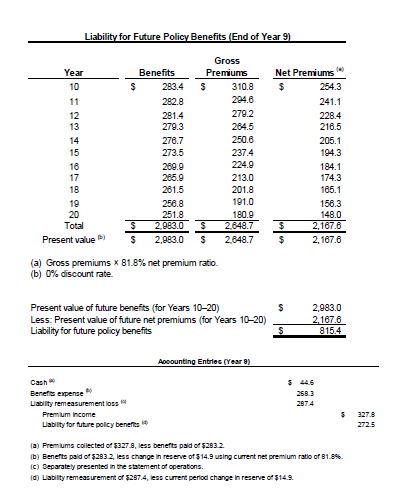

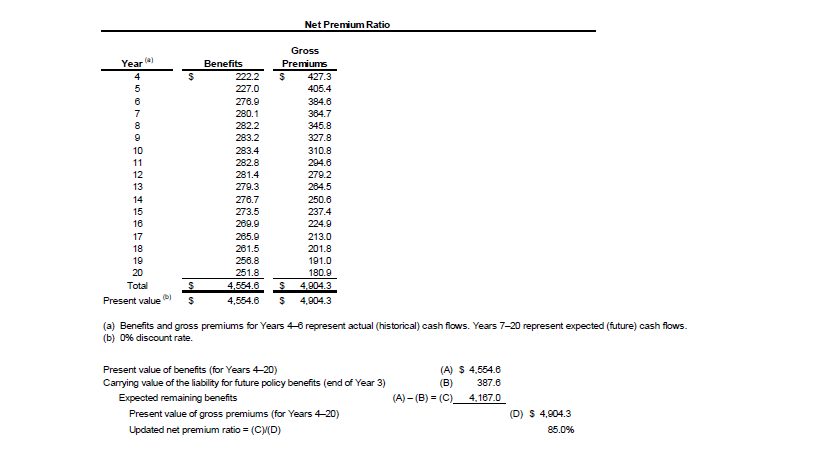

944-40-55-29N At the end of Year 9, the Entity reviews and updates its mortality assumption to reflect the unfavorable experience in that year and an increase in expected mortality in Years 10 through 20.

The following tables provide information about the estimated cash flow effects of updating the mortality assumption and the corresponding adjustment to the liability for future policy benefits and current-period benefit expense.

View image

View image

View image

View image

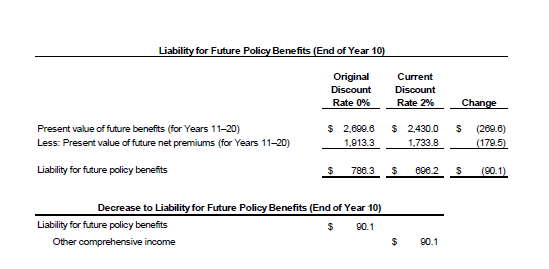

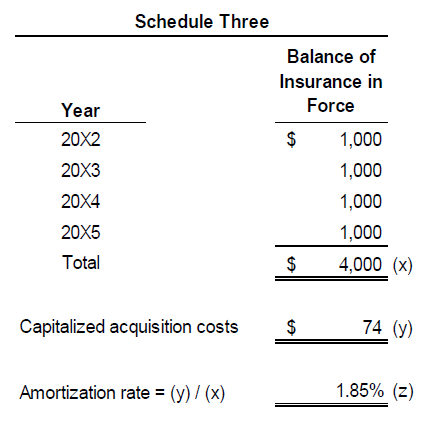

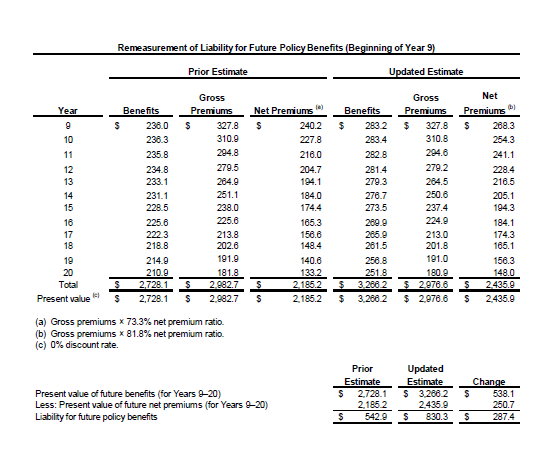

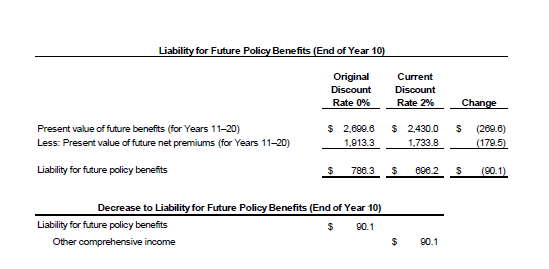

944-40-55-29O At the end of Year 10, the Entity updates its discount rate assumption from 0 percent to 2 percent.

The following table provides information about the effect of updating the discount rate assumption and the adjustment to the liability for future policy benefits and other comprehensive income.

View image

View image

> > Example 7: Updating of Assumptions Used in the Measurement of the Liability for Future Policy Benefits with a Carryover Basis

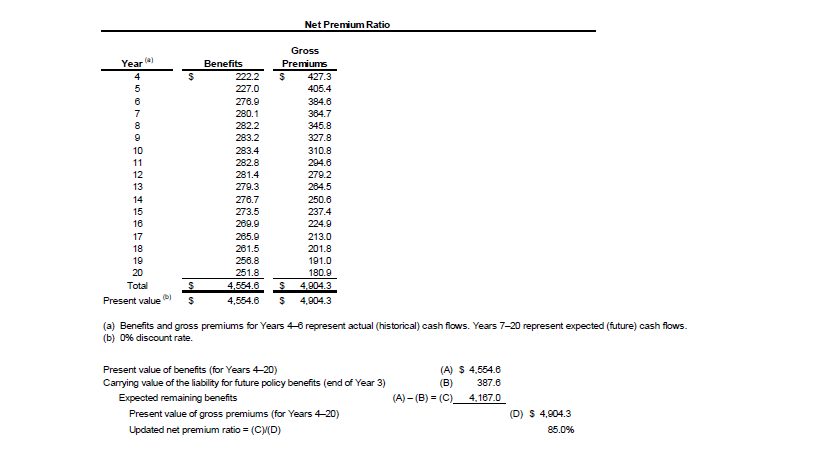

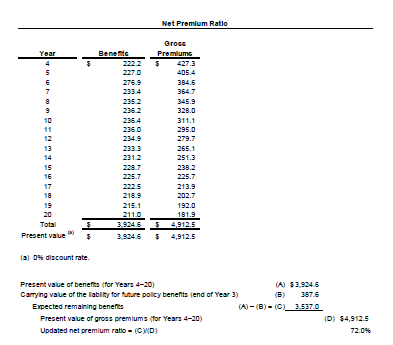

944-40-55-29P This Example illustrates an approach to updating assumptions used to measure the liability for future policy benefits with a carryover basis.

944-40-55-29Q This Example assumes the following for the contracts discussed:

a. The beginning of Year 4 carryover basis is $387.6, which will be used in subsequent recalculations of the net premium ratio.

b. At the beginning of Year 4, the Entity updates cash flow assumptions and recalculates net premiums.

c. A discount rate of 0 percent is used to compute the net premiums and the liability for future policy benefits.

d. For ease of illustration, no expenses are assumed, benefit payments and premium receipts are made at the end of the year, and annual periods are presented.

944-40-55-29R This Example illustrates computations that involve the following:

a. Net premiums

b. Updates of the net premium ratio.

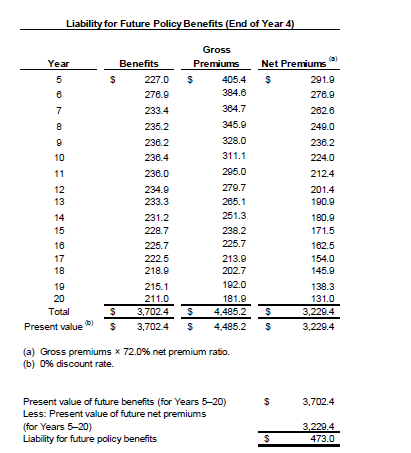

944-40-55-29S At the beginning of Year 4, the Entity recalculates the net premiums as follows.